Form R40: repayment of tax on savings and investments

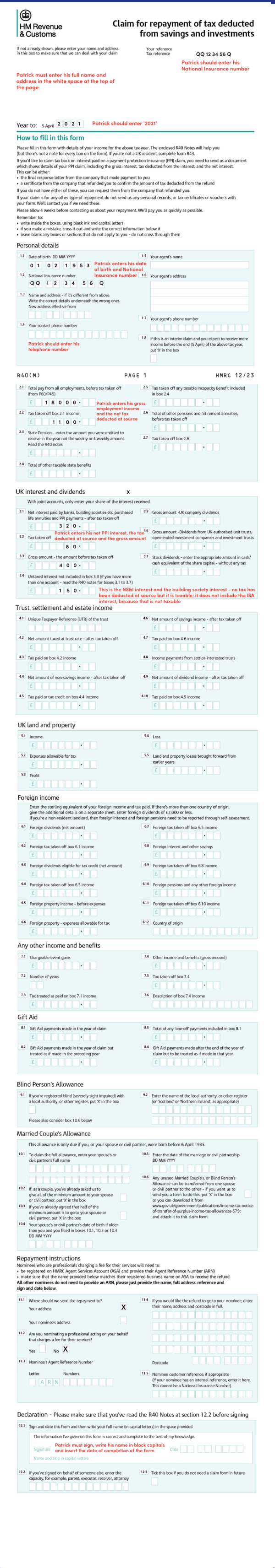

We provide information on form R40, including an annotated example to help illustrate how to complete it.

Content on this page:

Overview

You can use form R40 to make a claim for repayment of tax in certain circumstances:

- you are not within self assessment – that is you do not have to submit an annual tax return, and

- you have paid too much tax on interest from your savings and investments (including purchased life annuities or PPI payouts), and

- you are resident for tax purposes in the UK.

You can download form R40 from GOV.UK.

If you are unable to print the form off yourself (or with help from friends/a local library, etc.) then you will have to phone HMRC to request that they send you a copy. Some people have trouble getting through to HMRC, so you may find our hints and tips on contacting HMRC useful.

If you have any trouble in getting a form R40 sent to you by HMRC, please let us know – although HMRC are having a push towards 'digital', they have assured us that a paper form should still be available, if requested.

Alternatively, you can claim online through the Government Gateway. If you want to complete and submit the form online and have not got a Government Gateway account, you can set one up as part of the claim process. This will also give you access to other government and HMRC online services including your personal tax account. You can find out more about your personal tax account in our digital services page.

Time limits

You have four years from the end of the tax year to make a claim. So, for 2024/25, you must make a claim by 5 April 2029. As we are in 2024/25, you can make a claim going back to the 2020/21 tax year.

It is possible to use the form to claim a repayment of tax relating to the current tax year (known as an ‘interim claim’) if you know what your income is going to be for the year. You should complete the form using your best estimate for the total annual figures you expect to receive from each source of income and mark the form as an interim claim by ticking box 1.8. When HMRC receive the form, they will issue a repayment (if one is due) based on the estimated figures reported. After the end of the tax year, HMRC will then check the position and inform you if there is any discrepancy.

Method of repayment

HMRC make repayments by cheque – they will either send the cheque to you or you can ask them to send it to someone else (your nominee).

How to complete the form

We also suggest that you read through HMRC’s guidance on how to complete form R40, available on GOV.UK.

We use the annotated form plus example below to illustrate how you should complete form R40. Please do not use the details provided in the example when completing your own form.