Marriage allowance (transferable tax allowance)

The marriage allowance allows you to give up some of your personal allowance to provide an amount (a tax credit) that can reduce the amount of income tax that your spouse or civil partner pays.

Content on this page:

Marriage allowance or transferable tax allowance

The marriage allowance works by reducing the personal allowance of the donor spouse or civil partner, and providing a tax reducer (tax credit) to the spouse or civil partner who receives it, reducing their tax bill. It is not strictly an allowance in the hands of the person who receives it.

The marriage allowance is also known as the transferable tax allowance for married couples and civil partners. It should not be confused with the married couple’s allowance.

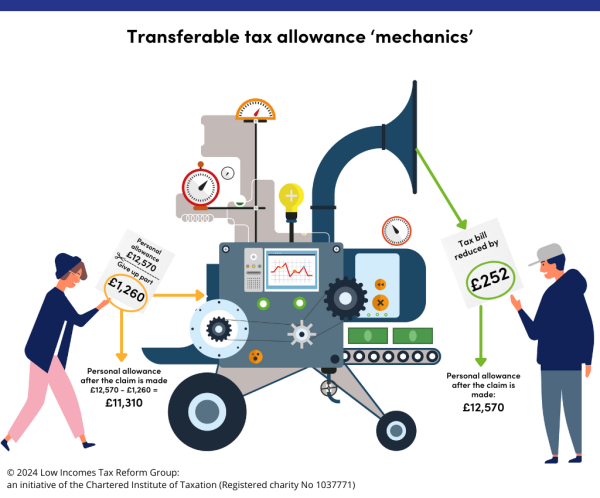

The marriage allowance for 2024/25 is £1,260.

This means that the donor spouse/partner gives up £1,260 of their personal allowance and the recipient spouse/partner receives a tax reducer (tax credit) of £252.

The maximum tax saving you can get as a couple from the marriage allowance is £252 for the 2024/25 tax year.

The recipient spouse/partner can set the tax reducer against their tax liability. If the tax reducer is greater than their tax liability, they will not receive a tax refund, nor will the donor spouse have their personal allowance readjusted.

The ‘mechanics’ of the marriage allowance can be illustrated as follows:

Note that if the recipient spouse or civil partner is in employment or is paid a pension (other than the state pension) their PAYE code may be amended as if they received an extra £1,260 (for 2024/25) of allowances. This is indicated by the addition of an ‘M’ to the tax code. Similarly, the individual giving up part of their allowance should have an ‘N’ after their primary tax code (if they have one).

Eligibility

You can only claim the marriage allowance if both you and your spouse or civil partner meet certain conditions.If one of you was born before 6 April 1935, you should consider claiming the married couple’s allowance instead as it will usually be more beneficial.

All of the following conditions must apply:

- You must be married or in a civil partnership (for more information on this, see the heading below: Changes in marriage or civil partnership status)

- You do not pay income tax at a rate higher than the basic rate (or higher than the intermediate rate if you are a Scottish taxpayer)

- Your partner does not pay income tax at a rate higher than the basic rate (or higher than the intermediate rate if they are a Scottish taxpayer)

When calculating the highest tax rate at which either spouse/partner is liable, you should ignore the personal savings allowance and/or dividend allowance and consider whether the savings and/or dividend income would be liable to the higher rate (40%) or dividend upper rate (33.75%) were it not for those allowances.

Timing of claims

If you make the claim during the tax year for which you are claiming (so after 5 April 2024 and before 6 April 2025 for the tax year 2024/25), the claim continues until either you withdraw it or the recipient spouse or civil partner does not obtain a tax advantage.

On the other hand, if you make the claim after the end of the relevant tax year, it will only have effect for the tax year to which the claim relates. So, if you make a claim after 5 April 2025 for 2024/25, you would need to make another claim for 2025/26 if appropriate.

The claim can be made up to four years after the end of the relevant tax year. For example, a claim for marriage allowance for the tax year 2024/25 must be made by 5 April 2029.

The first year that the marriage allowance could be claimed was 2015/16. Any claims for that year had to be made by 5 April 2020. From 6 April 2024, claims for the 2016/17, 2017/18, 2018/19 and 2019/20 tax years are also out of time. You can read more about claiming a marriage allowance tax refund for previous years on our page Marriage allowance tax refunds.

It is possible to make a claim even if one of the parties to the marriage or civil partnership is no longer alive – for more information, see our page Death of a spouse or civil partner.

Warning: if you decide to claim the marriage allowance you must claim all of it (£1,260 in 2024/25). In some cases, this could leave you both worse off overall. This may happen if your income is more than 90% of the personal allowance (that is, more than £11,310 in 2024/25) and your spouse or civil partner’s income is less than 110% of the personal allowance (that is, less than £13,830 in 2024/25).

You can see how this can happen in the example below.

If your incomes are variable, it may be better to wait until you are certain that a claim will be beneficial before making the claim.

If the recipient spouse or civil partner files a self assessment tax return for the year it applies, you should try to ensure that HMRC have a record of the donor having made the claim before that return is submitted. This is so that HMRC do not automatically adjust the tax calculation to remove the tax credit. If both the spouses or civil partners file self assessment tax returns, the donor should therefore submit their tax return first if possible.

Withdrawing a claim

If you wish to withdraw a marriage allowance claim (for example, because it is no longer beneficial) you should note that only the individual who originally made the claim (by allowing their personal allowance to be reduced) may withdraw the election. The withdrawal of the election then only takes place from the start of the following tax year.

Changes in marriage or civil partnership status

To make an election for marriage allowance for a given tax year, you need to be married to, or in a civil partnership with, the same person (that is, the person who will be receiving the allowance):

- for the whole or part of the tax year concerned, and

- at the point the election is made (or if the election is made after the death of one or both of the parties, then when they were both last living).

The marriage allowance is therefore available in full, if the other conditions are met (see above), for the year in which a marriage or civil partnership takes place.

Similarly, if you separate from your spouse or civil partner in a tax year, the marriage allowance is still available in full for that year if the other conditions are met (see above), but the election must have been made prior to the separation. An election remains in place in the tax year of the end of the marriage or civil partnership, unless the person giving up part of their allowance revokes their claim.

The marriage allowance is not available for any tax year after your marriage has ended (by divorce) or your civil partnership has been dissolved.

It is not possible to claim the marriage allowance after you are divorced or your civil partnership is dissolved, even if the claim would be for a time when you were still married or in a civil partnership.

For the purposes of marriage allowance, a marriage comes to an end if any of the following is made:

- decree absolute of divorce (decree of divorce in Scotland)

- decree of nullity (declarator of nullity in Scotland)

- decree of judicial separation (decree of separation in Scotland)

A civil partnership comes to an end if any of the following is made:

- dissolution order or nullity order, which has been made final (decree of dissolution or a declarator of nullity in Scotland)

- separation order (decree of separation in Scotland)

If an election is withdrawn, it usually has effect for the tax year after the one in which the notice was given (see above under the heading: Withdrawing a claim). However, if the marriage or civil partnership comes to an end during the year in which the election is withdrawn, the marriage allowance is withdrawn for that year. So, if the election is withdrawn in August 2024 and the marriage or civil partnership comes to an end during the tax year 2024/25, then the allowance will not be available for 2024/25.

Claiming marriage allowance

You can apply for marriage allowance online on GOV.UK. If you cannot claim online, you can telephone HMRC on 0300 200 3300 to make the claim or download form MATCF to make the claim.