Gift aid

Gift aid is a tax-efficient way of making gifts or donations to a certain charities or sports clubs.

Content on this page:

Charities and sports clubs which can benefit

Gift aid can apply to donations to UK-registered charities.

Gift aid can also apply to gifts (not membership subscriptions) made to Community Amateur Sports Clubs (CASC).

References on this page to gift aid payments to a charity include donations to an eligible CASC.

Individual benefits

For basic rate (20%) taxpayers – which covers most people in the UK – the benefit of gift aid is to the charity rather than to you. But if you feel passionately about supporting a charity, you will of course be pleased that the charity gets a bit extra on top of what you can afford to give.

If you pay tax at more than the basic rate, you can get some extra tax relief too. You will have to claim it from HMRC.

Watch out, though: if you do not pay any income tax or capital gains tax, you should not make donations under gift aid. We explain this below, under the heading If you don’t pay any (or not much) tax.

Claiming gift aid

The process is very simple. The charity will ask you to complete a form which includes a gift aid declaration.

This form requires all of the following:

- the name of the charity

- your name

- your address (including postcode)

- the date

- confirmation that you are a UK taxpayer

- confirmation of the donations to which the declaration relates (for example, whether to a particular donation or to all donations).

If you have not paid enough UK tax (income tax or capital gains tax) during the tax year in question to match the tax the charity will reclaim on the gift, you should not make donations under gift aid. We explain this further below, under the heading: If you don’t pay any (or not much) tax.

Basic rate taxpayers

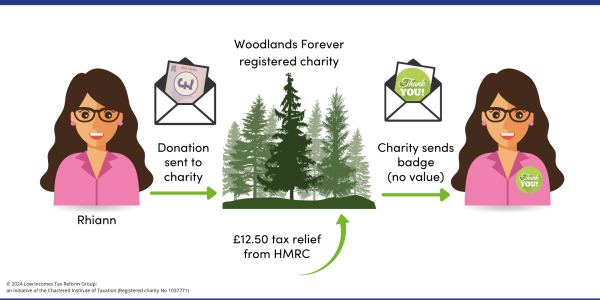

When you make a gift aid donation, you use money that has already been taxed. If, like most taxpayers in the UK, you are a 20% taxpayer, you will have made your donation out of income that has already suffered 20% tax.

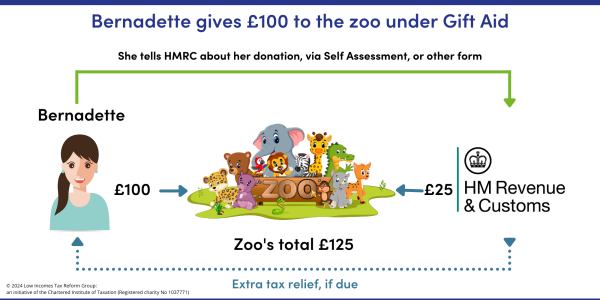

The charity will take your donation and then reclaim from HMRC the 20% tax that you originally paid.

If you are a 20% taxpayer, this gives the correct tax relief straight away.

If you make your donation using a digital platform, or otherwise using a credit or debit card, an administration fee may be deducted from the amount received by the charity. In this case, the amount which is eligible for relief is the amount before that fee has been deducted.

If you pay tax higher than the basic rate

If you pay tax at the rate of 40% or more (or, for Scottish taxpayers, 21% or more – see below under the heading Scottish taxpayers), you can claim back extra tax from HMRC. This will be the difference between the higher tax you have paid and the 20% tax already claimed by the charity.

If you normally complete a self assessment tax return, tell HMRC about your gifts to charity – and claim any tax relief – by completing the appropriate section on your tax return.

If you do not complete a tax return, you can contact HMRC to give them the details.

The way higher rate tax relief is given is by HMRC increasing your basic rate band by the amount of the gross gift aid donations. The basic rate band is the amount of income which is charged to tax at the basic rate – £37,700 in 2024/25.

If you pay tax at a rate higher than 20% through PAYE, HMRC can give you tax relief on gift aid donations through your tax code. This means your employer or pension provider will take less tax off your wages or pension.

You will only be eligible for this higher-rate relief to the extent you have income of at least the gross amount of the donation(s) which would otherwise be charged to taxed at the higher rate.

If you do not get tax relief via PAYE, you may have to obtain a refund directly from HMRC.

It is therefore important to keep records of all your donations made under gift aid.

Lightbulb Tip: claiming the tax relief yourself should be straightforward. Some businesses target taxpayers who have tax relief to reclaim on their gift aid donations. Their service may be to contact HMRC on your behalf telling them about your circumstances and donations – for a fee. You can avoid incurring fees unnecessarily by doing this yourself, unless you have other complications with your tax affairs and need to seek advice.

Scottish taxpayers

If you are a Scottish taxpayer, you can find out more about how this affects gift aid on our Scottish income tax: more detail page.

For 2024/25, Scotland has income tax rates of 19%, 20%, 21%, 42% and 47%.

Those paying 19% are treated in the same way as 20% taxpayers – but may need to take extra care that they have paid enough tax to cover the gift aid claim.

Those paying 21%, 42% or 47% can claim extra relief in the same way as those in the rest of the UK, as described above.

If you don’t pay any (or not much) tax

To use gift aid, you should have paid enough income tax or capital gains tax to HMRC in the tax year in which you make your donation – at least equal to the amount that the charity will reclaim. The charity will ask you to sign a gift aid declaration confirming that you understand the consequences where this is not the case.

You do not have to be working to pay income tax. Apart from tax on income from a job or self-employment, you might pay tax on your pension or investments, such as rental income. Other taxes such as VAT and council tax, or National Insurance, do not qualify. Certain income tax charges are also excluded, such as income tax paid on a deferred state pension lump sum.

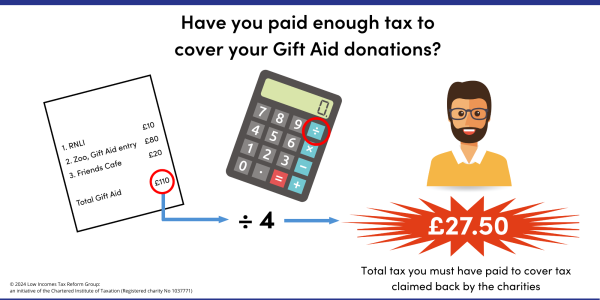

To work out if you have paid enough tax to cover your donations, divide the donation value by four and compare this figure to the amount of tax that you have paid for the year.

If you have not paid enough tax but make a gift aid donation, you may have to make up the difference in income tax to HMRC. Alternatively, in limited circumstances it may be possible to cancel an oral gift aid declaration on a donation you have already made (see below under the heading Cancelling a gift aid declaration). If you have not yet filed your tax return for the previous tax year, then you might be able to carry back the donation to that year instead (see below under the heading Carrying back gift aid donations).

Remember to add all the gift aid donations you have made in the tax year and that any tax at source is only an estimate and so may not be the final amount due to HMRC – you may be due a refund or have a balance to pay. See Working out your tax for more information.

Due to the personal savings allowance and the dividend allowance, you might not need to pay tax on your savings interest or dividends. Both dividends and bank interest are paid gross (no tax is deducted before you get them).

If your income goes down

Where you donate to charity under a continuing gift aid declaration, the charity will continue to assume the donation has come from someone paying tax. If your income goes down, you might then be faced with a bill from HMRC for the amount the charity has claimed. Therefore, each year, check your tax paid against the tax reclaimable by charities on your ongoing gift aid donations.

If your tax liability reduces so that it is not enough to cover your gift aid donations, you may wish to cancel your gift aid declaration. You can still donate to charity, but the charity cannot claim gift aid relief from HMRC for future donations. You should also bear this in mind when visiting attractions which invite you to gift aid your entry ticket.

Other gift aid rules

Gift aid donations must be genuine. This means that the gift must be your money – you cannot, for example, collect donations from others and claim gift aid on the donation yourself.

Gift aid donations must also be made voluntarily, and you cannot get anything (or not anything much) back in return for your donation.

If you do get anything back from making a gift, it should not be worth more than the limits shown below (unless it is a benefit that is not counted).

| Donation | Maximum value of benefit |

| Gifts up to £100 | 25% of the donation |

| £101+ | £25 plus 5% of the value exceeding £100 (overall maximum benefit is capped at £2,500) |

Gift aid cannot be claimed if the amount given is essentially a payment for goods or services, for example, goods bought in a jumble sale or an entrance ticket for an event (but you can claim gift aid if you agree to pay extra for your entry to an attraction – see immediately below).

Other ways to claim gift aid

You might be able to claim gift aid in other situations, for example:

- If you go to a visitor attraction, such as a museum, zoo or heritage property, you may be asked if you are willing to pay a little more (normally 10%) for your entry ticket so that the charity may claim gift aid.

- If you sponsor someone to take part in a charity event, you may be asked if the charity can claim gift aid on your sponsorship.

- If you donate goods, some charities run a scheme under which the amount they raise from selling your items can be treated as a gift aid donation.

In each of those cases the rule about paying enough tax still applies – only give under gift aid if you are certain to pay enough income tax or capital gains tax in the tax year to cover the amount of tax reclaimable on all your gift-aided donations. You can claim tax relief on these donations in the same way as if you had simply made a cash gift.

Other tax impacts

Gift aid donations are taken into account when working out your 'adjusted net income' for tax purposes. This means that the amount you gave to the charity is added to the tax relief the charity reclaim and this total amount is taken off your taxable income.

This lower adjusted net income figure can reduce the amount of tax you pay, because it is used to work out, for example:

- the amount of any personal savings allowance you get

- whether your personal allowance has to be reduced, where income is above £100,000 a year

- how much high income child benefit charge you have to pay

- how much married couple’s allowance you can get

You can read more about adjusted net income on GOV.UK.

Gift aid donations can also affect the amount of capital gains tax you pay, if you have a gain which is taxed at a mixture of rates. Because the gross gift aid contributions extend your basic rate band, the amount of the gain charged at the lower rate would be increased by the same amount.

Carrying back gift aid donations

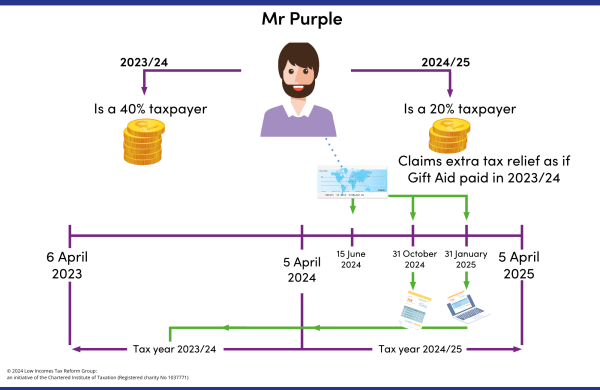

In some cases, gift aid donations can be carried back and treated as if they were made in the previous tax year.

This can be helpful where you were a higher rate taxpayer in the previous tax year but are now a basic rate taxpayer. Alternatively, you may wish to carry back a donation if you did not pay enough tax in the current tax year but you did in the previous year.

If you carry back a donation, you must carry back the whole amount of it.

When you are completing your self assessment tax return for a year, you can only elect to carry back contributions to that year, and not from it. The election must be made in your original tax return for the year to which you are carrying back the contributions, and before the normal self assessment filing deadline for that year (we understand that this is generally interpreted as 31 January following the end of the tax year, even in the case of a paper tax return or if a notice has been issued late by HMRC).

If you made gift aid contributions in 2023/24 and you realise when completing your 2023/24 tax return that you did not have sufficient taxable income to avoid a gift aid tax charge, unfortunately you cannot now carry back these contributions to 2022/23.

Similarly, payments made on or after 6 April 2024 can only be included in your Self Assessment tax return for the year ended 5 April 2024 on an original 2023/24 return which is sent to reach HMRC before 31 January 2025.

If you have made a gift aid carry-back claim in a tax return for a year, then when you are completing your tax return in the following year (that is, the year in which the contributions were actually made), you should report the amount of the contributions made in the year which you have previously elected to carry back. For example, the contributions made in 2023/24 which were carried back to 2022/23 on your 2022/23 tax return should be reported in box 7 of page TR4 of your 2023/24 return (or the equivalent box in the online system).

Cancelling a gift aid declaration

If you have made an ongoing gift aid declaration to a charity which covers future donations, you can cancel this by notifying the charity. The gift aid declaration will no longer have effect in relation to donations made after the date on which you made this notification (or on such later date as you specify in the notification).

It is not normally possible to cancel gift aid declarations in relation to donations you have already made.

The main exception to this is where you have made an oral gift aid declaration for a donation (or donations). In this case, the charity is required to send you a written statement regarding the donation(s) within 30 days. You can then retrospectively cancel the gift aid declaration within 30 days of that statement by giving notice to the charity (either orally or in writing, including by email).

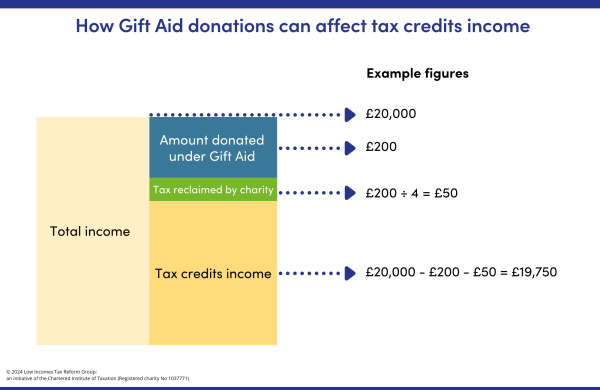

Tax credits

If you claim tax credits, you can deduct the gross value of any gift aid donation from your income when you declare it for the purposes of renewing your claim. This could have the effect of increasing your entitlement to tax credits.

So, if your annual income is (say) £20,000 and you make gift aid donations of £200 net, your income for tax credits will be £20,000 less £200 plus the tax thereon, that is £250, a total of £19,750.

Universal credit

If you are employed and you make charitable donations under a payroll giving scheme, then the amounts withheld from you can be deducted from your employed earnings for universal credit purposes. The amount of earnings reported by your employer to the Department for Work and Pensions should be after the donations have been taken off, in which case there is nothing for you to do.

Otherwise, unlike for tax credits, gift aid contributions are ignored for universal credit purposes.

More information

There is information on payroll giving and gift aid on GOV.UK.

You may also find HMRC’s helpsheet 342 Charitable giving useful.