Elective Deductions Model (EDM) – an explainer for advisers

The EDM is a concerning model of engagement aimed at low paid workers in the temporary labour market, which exploits the fault line between employment law status and tax law status. We have had guidance on our website to help workers steer clear of the EDM for many years. However, recently there appears to have been an increase in its use.

As it may be useful to advisers of workers or businesses in supply chains, here we look at the model in more detail, explain what is behind the increase and set out what we think HMRC should do about it.

Background to the EDM

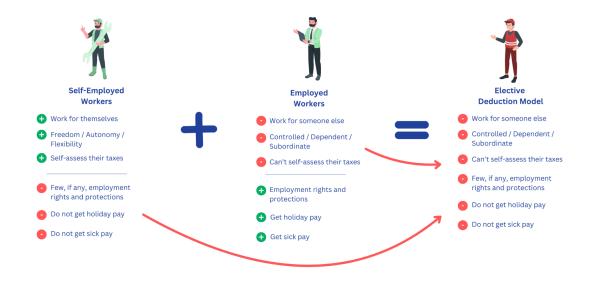

Employment status is at the heart of both employment law (where there are three statuses that determine what rights people have) and the tax system (where we have two statuses that determine how people pay their taxes). It is possible to have one status for employment law and another status for tax law.

Status in both regimes can be uncertain, unclear and complicated to determine, particularly at the boundaries. However the employment status of low paid agency workers is usually quite clear:

- They will typically have ‘worker’ status for employment law rights or ‘employee’ status if they work through an umbrella company

- They have employee status for tax purposes - either under the deeming provisions in the agency legislation or under general principles where they work through an umbrella company.

In the EDM however, engagers are treating individuals as self-employed for employment law purposes and employed for tax law purposes.

What is the problem with the EDM model

In the EDM, workers are typically given a contract for services, with an opt in to PAYE. Here are some clauses of the type you might find in an EDM contract:

- Under this contract you will not be an employee or worker for general statutory employment rights purposes.

- All payments to you for services will constitute employment income but for tax and NIC purposes only.

- We will deduct PAYE and Class 1 NIC from payments made to you. We will also account for Secondary NIC on all payments made to you.

- Otherwise than as stated, you are self-employed.

- You do not have any statutory right to paid holiday.

The clauses above are trying to labour the point that the worker is self-employed. But case law tells us that labels and paperwork are ignored if they don’t reflect the actual working arrangements and the nature of the relationship between the parties involved. In reality, it would be extremely unlikely for an agency worker to be genuinely self-employed for employment law purposes. No matter which way you look at it or dress it up, they work for someone else/they are not in business on their own account.

As we illustrate below, the EDM is arguably a form of false self-employment – which appears to deny workers the employment law rights and protections they are entitled to, to save the engager concerned money. However as far HMRC are concerned, PAYE is being operated as required and everything appears to be in order.

Where did EDM come from?

EDM was first seen following the onshore intermediary legislative changes from April 2014, designed to clamp down on ‘self-employed’ agency workers. But – as we pointed out in our 2014 consultation response - these changes worked for tax purposes only. We said it was a piecemeal approach that didn’t offer a complete solution and would therefore be exploited.

As we envisaged, it wasn’t long before the EDM emerged. You can see on the left below, a snippet of a news article that we wrote in May 2014 essentially flagging the EDM. At the same time, as you can see on the right, due to the contrived nature of the model, many were convinced it would have a short shelf live.

Larger version of image can be seen here.

Roll forward 10 years and the EDM is not a niche solution in a limited part of the temporary labour market. From a brief look on the internet, we can see it is being openly marketed throughout the agency/umbrella industry, with websites saying things like:

- Even though they are under PAYE, subcontractors keep their self-employed status.

- The model recognises a self-employed status whilst paying them under PAYE. However they are still able to claim expenses and reduce their tax.

- It complies with the legislation by treating the self-employed individuals as employees for income tax and NIC. However for all other purposes, NMW, holiday pay, SSP, SMP etc, the individuals are self-employed.

What is the impact on workers if they are in this model?

The main issue is that they are usually being incorrectly denied holiday pay or are being underpaid the National Minimum Wage (NMW) – the rate paid for them doesn’t cover both as the example shared below explains.

They are also missing out on other ‘worker’ rights – e.g. pension auto enrolment, which has longer term consequences.

Our understanding is that in some cases, workers in this model are being denied statutory payments like sick pay. (We find this odd because statutory payment are not connected to employment law status – they depend on whether or not someone is paid though PAYE and there is a secondary contributor!)

There may be other less visible impacts too, for example, if workers are claiming expenses which are not allowable, or even putting themselves in the complex self-assessment regime because they think they are self-employed. Getting in a muddle and falling into tax non-compliance has significant consequences for workers.

What’s behind the increase in EDM use?

In a nutshell, the recent large rises to the National Minimum Wage are likely the biggest driving factor, coupled with the fact no action has been taken to close this model down (more on this below).

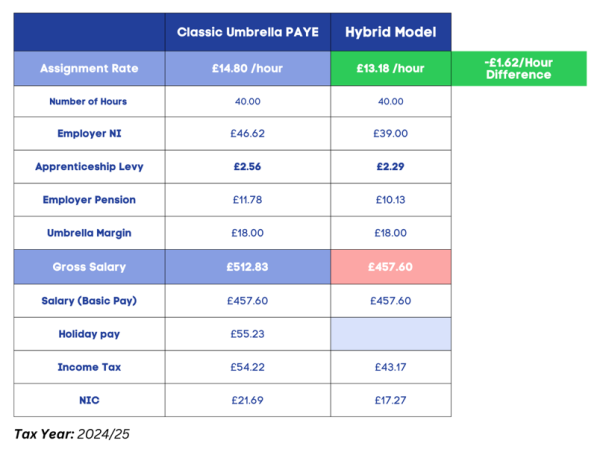

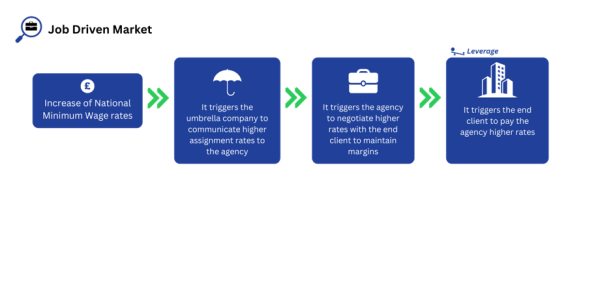

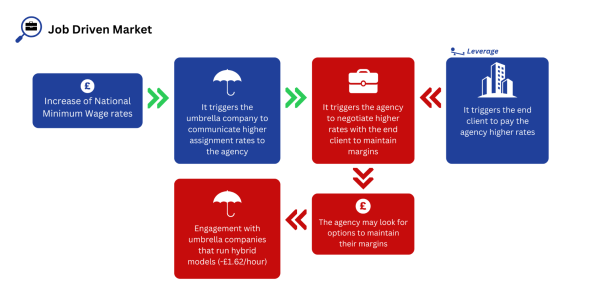

Under normal circumstances an increase in the NMW would trigger everyone in the supply chain to renegotiate rates (see diagram 1 below). The EDM offers a solution to supply chains in job driven markets (basically where there are more candidates than jobs) where end clients have leverage and where there is simply not enough money flowing through the supply chain to allow everyone involved to cover costs and make their margin. This is demonstrated in the diagram 2 below.

Exactly how prevalent is it?

From information shared with us by SafeRec, based on a recent sample of umbrella company payslips audits, it appears that around 10% of all failed payslips have failed because of EDM. This sample was taken before the most April 2024 NMW increase from £10.42 to £11.44, so it is likely this percentage will have increased.

Why HMRC should act (even though this isn’t a prima facie tax problem!)?

So firstly – and perhaps most obviously, EDM suppresses taxable pay, which means indirectly it is causing tax loss. In the table below, we can see a yearly figure for this, extrapolated from the scenario set out in the example above. Of course it is unlikely that an agency worker would stay in any particular assignment for an entire year, but if they are signed up with an agency or an umbrella that uses EDM, then it is likely that they will be paid through EDM for each and every assignment they undertake through that agency/umbrella.

Now extrapolate £1,215 tax loss per worker, per year over the entire industry - it doesn’t take many workers to be under this model, before some big numbers become involved. And this is before considering the effects of the ‘perceived compliance’ of EDM in the industry and it potentially acting as a ‘gateway’ towards using more serious non-compliant models, such as the Mini Umbrella Company model.

If tax loss alone isn’t enough, the fact that HMRC enforce NMW and statutory payments - should provide additional incentive - and opportunity – for them to get involved.

This could also cause some reputational damage to HMRC. In our experience, people associate umbrellas with HMRC – no matter what the underlying mischief is! Letting this model subsist in the labour market, with all of the concerns highlighted above, potentially damages trust in the system, which as tax professionals we should all be worried about.

Finally – if HMRC don’t act, no one else will. As a matter of economic reality, few low paid workers will recognise the concerns with this model or have the ability to be able to enforce their employment law rights, even if they do. As there is no other real state enforcement of status or holiday pay to help protect their positions – it stays under the radar and goes unchallenged.

What should HMRC to do?

The good news is that we think a simple statement from HMRC, setting out that EDM schemes are unacceptable and why, could go a long way. It would support workers and compliant businesses by giving them important leverage and it would send a strong message to those selling the schemes that it is unacceptable.

There is precedent for this approach – in 2012, HMRC issued a statement on Paydaybypayday, which did seem to help ultimately lead to its downfall. And while we recognise that HMRC may need to collaborate with the Employment Agency Standards Inspectorate (EAS) as it cuts across their work around agencies, the other good news is that EAS seem to have taken a similar approach in this area – for example they have released their own statement on Joint Employment.

We have put forward this suggestion for a quick, easy, practical intervention to HMRC. It is now a case of watch this space. We have also raised it in the context of the NMW considerations – most recently with the Low Pay Commission. In the meantime, we urge everyone to be on the lookout for EDM and would appreciate advisers sharing and promoting this blog with their contacts and networks.