Payslips: information for employers

This page explains more about payslips, such as what information they should include and how to create one for your employee.

Content on this page:

What a payslip is

An employee has the right to know the amount they will be paid, how often and by what method (for example, every Friday, in cash, by cheque or directly to a bank) – typically these terms will be set out in the employment contract or written particulars.

Employees are also entitled to receive an individual, detailed written pay statement each time you pay them. This is a payslip. It must show specific items, including:

- the employee's gross pay (before any deductions are made) - separating out any rolled up holiday pay

- any fixed deductions – for example, trade union subscriptions

- any variable deductions, for example, tax

- the net amount payable after the deductions have been made (‘take home pay’)

- the amount and method for any part payment of wages (for example, separate figures where there is a cash payment and the balance is credited to a bank account).

Since April 2019, payslips are also required to state the number of hours being paid where wages vary according to time worked; either as an aggregate number of hours or as separate figures for different types of work (or rates of pay). This means that if you pay your employee on an hourly basis, all the hours worked in their pay period must be included on their payslip, because they are all paid on the basis of how much time they worked. Government guidance on the requirements, including examples, is available on GOV.UK.

For completeness, you might include additional information on your employee’s payslip which you are not required to provide by law, such as:

- National Insurance number

- tax code

- Employer PAYE reference – your employee may need this to make a claim for tax relief for employment expenses

- breakdown of additional payments like overtime, tips or bonuses, which must in any case, be included in the gross pay figure.

Depending on the employee's circumstances you may also need to include other payments and deductions on their payslip, for example Statutory Sick Pay, Statutory Maternity Pay, and/or pension or student loan deductions.

Giving an employee a payslip is a legal requirement and you must issue it at, or before, the time you pay your employee. Please note that this is the case even if you are not required to make tax or NIC deductions under PAYE. This is because your employee may still need an official record of their earnings should they need to do things like complete a tax return, claim state benefits or seek loans or other finance.

You can find more information on payslips on the ACAS website.

Where to get payslips for your employees

Payslips can be handwritten on paper (you can make them ‘freehand’ or blank payslips can be purchased from most stationers) or can be formulated and delivered in an electronic format (such as on an excel spreadsheet or by email – although see warning directly below).

If you are using payroll software, in most cases this will produce a payslip for you that you can send to your employee or print off and give to them. If you are using HMRC’s free Basic PAYE Tools package, a payslip can be created as a part of this.

Emailing payslips – a warning

Email is widely accepted as not being a secure way of transmitting information - emails are easy to hack or intercept, and something as simple as a typo in an email address can lead to incorrect delivery and a subsequent data protection breach (bearing in mind that payslips contain personal and financial information).

If you want to email your employee's payslip to them, you must ensure your employee is happy to accept the risks that go along with that and you should then take steps to securely protect the payslip, for example, via password protection. You should also make sure you enter the employee's correct email address (and ask your employee to notify you if they change their email address).

If you are not sure whether emailing is secure, it may be best to print it off and physically give the payslip to your employee or post it to their home address.

To avoid any risks and to be safe and secure with employees’ data, many employers now use online payslip portals to post their employee’s payslips – these can come with certain payroll software packages or can be bought as standalone service that integrates with your existing payroll software. Employees will require log in details and passwords to access them, which can sometimes be lost or forgotten. But it is very important that employees do go in to check their payslips regularly. If they leave, they must make sure they download copies of all their payslips beforehand, as they may be unable to access them after they have left. Most systems may, however, have admin settings that can be easily changed to give ex-employee’s certain permissions for a period of time.

Understanding a payslip

Knowing your way around your employees’ payslips will help you understand whether they have been paid correctly and that the right amounts of tax and National Insurance have been paid on their behalf, so that you can explain things to them if necessary. You should encourage your employees to keep their payslips somewhere safe in case they need them.

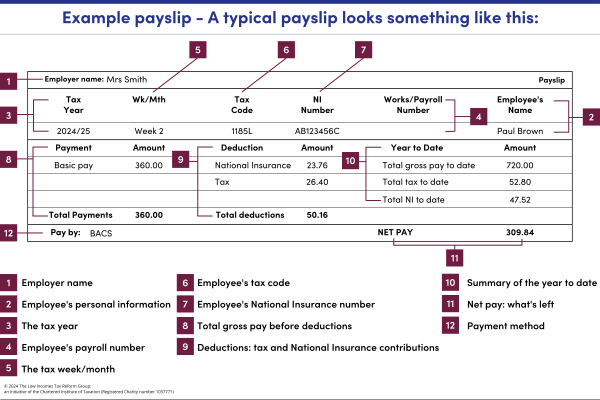

As such, the following breakdown may assist you to understand the various elements of a standard looking payslip:

- Employer Name

Your name - Employee’s personal information

Your employee’s name and sometimes their home address will be shown. - The tax year

A tax year runs from 6 April in one year to 5th April in the next. The tax year starting on 6 April 2024 and finishing on 5 April 2025 will usually be shown as 2024/25 or 24/25. Please note that sometimes the tax year will show as the first year that the tax year covers. For example, 2024/25 would be 2024 (2023/24 would have been 2023). This follows the same system adopted when the Government Finance Acts are produced each year – for example Finance Act 2024 is mainly concerned with the 2024/25 tax year. - Employee’s payroll number

If you have more than one employee you might find it helpful to allocate payroll, or employee numbers to them to help identify them. - Wk/Mth

The number here represents the tax period for that payslip, for example if you are paid weekly in 2024/25 then week 01 is week from 6th April to 12th April. If you are paid monthly, then month 01 is April and month 12 is March. Our payroll calendar will help you identify tax periods.

Remember that we use the week or month that includes the payday. For example, if your employee is paid on 12 April 2024 but for the week 25 March – 29 March 2024, the payday will fall in week number 1 of the 2024/25 tax year not week 52 of 2023/24. If they are paid on 19 April 2024 for the week 1 – 5 April 2024, this will be week number 2 and so on. - Employee's tax code

Your employee’s tax code will be set by the starter procedure or sent to you by HMRC (either in the post or by an internet notification if you are registered to use PAYE Online for employers). It is the code that tells you how much tax-free pay your employee should get before deducting tax from the remainder.

On this payslip there is a code of 1185L, so this means the employee has some adjustments in his tax code. If the code is wrong, your employee could end up paying too much or too little tax, so you should encourage them to check their notification of tax code and talk to HMRC if there are any problems. - Employee's National Insurance (NI) number

This is usually shown on a payslip. - Payments

This will show how much your employee has earned in wages before any deductions are made. From April 2019 for hourly paid workers, it should also show how their pay is calculated, for example the hourly rate and the number of hours worked. It could also show any extra payments they have earned on top of basic pay like bonuses, or overtime. - Deductions – tax and National Insurance contributions

Your payslip must show the amount of variable deductions, like tax and National Insurance, and any contributions your employee is making to a workplace pension. For more on other deductions you might see, go to our section pay and deductions. - Summary of the year to date

Some payslips will have a section which shows how much your employee has been paid so far in this financial year (from 6 April to 5 April). It might also show totals for how much your employee has paid in tax, National Insurance, student loans and pensions. - Net pay: what is left

The most important figure on the payslip for most people is their take-home pay. This is the amount your employee actually receives once all the deductions have been made. - Payment method

The payslip may also show the method of payment, e.g. cash, bank transfer etc.