Free umbrella company payslip audit

If you’re employed through an umbrella company and want to understand if they are dealing with your pay and taxes correctly, you can request a free payslip audit. This audit will be carried out by special software developed by compliance and technology firm SafeRec, who have kindly provided LITRG with free access to the tool.

Content on this page:

Introduction

SafeRec’s software reads and forensically audits umbrella company payslips. This means that SafeRec’s software can help workers identify that they may be being paid in a non-compliant way, such as through disguised remuneration. But it may also identify other potential abuses, such as skimming or being in an Elective Deduction Model. You can find out more about such problem areas on our main umbrella company page.

Process

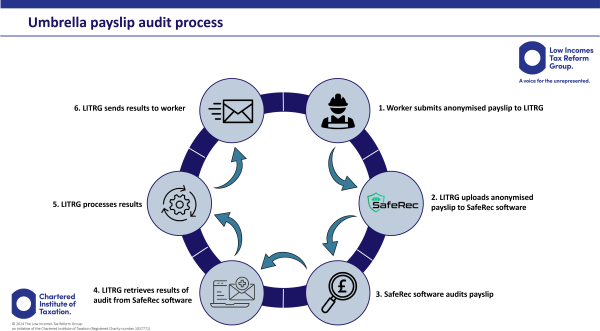

The process for requesting a free payslip audit works as follows:

- Worker submits anonymised payslip to LITRG

- LITRG uploads anonymised payslip to SafeRec software

- SafeRec software audits payslip

- LITRG retrieves results of audit from SafeRec software

- LITRG processes results

- LITRG sends results to worker

To view a larger version please see below

Note: Although we can’t offer any guarantees, we’ll aim to return the results to the email address provided by you, within seven working days. Where this is not possible, for example if there is downtime or a technical issue with the SafeRec software that is beyond our control or there are availability or processing issues at our end, we will return the result to you as soon as possible. Please ensure there is sufficient space in your inbox to receive emails. Please also check your junk folder in case results are delivered there. If, for any reason we are unable to provide you with a payslip audit, we will let you know by email.

Payslip audit – more detailed information

You can request a SafeRec payslip audit by:

- completing a form on our website with some of your details

- accepting our terms and conditions, and

- uploading an anonymised copy of a recent payslip/contractor reconciliation statement (you will usually find these on the same document).

If the payslip/contractor reconciliation statement does not contain the pay and tax information required to be able to proceed with the audit, we will let you know as soon as possible.

The payslip audit, powered by SafeRec’s AI technology, should provide you with a more thorough insight into your payslips. It analyses your pay and deductions line by line, checks calculations and highlight potential discrepancies or errors that may need some further checking or follow up. You will be provided with a detailed report outlining SafeRec’s findings.

Please note - the payslip audit is not undertaken by LITRG. It is provided by SafeRec - a third party. As such, we cannot take responsibility for their practices or guarantee the accuracy or completeness of the payslip audit. You must review SafeRec’s terms and conditions before asking LITRG for a payslip audit.

Your data

In order to provide the service you have requested, we will need to collect and process your personal data, payslip and the payslip audit results. We need your personal data, such as your email address, in order to communicate with you about the audit and send you the results. This data will not be shared with anyone outside of LITRG and will not be used for any purpose other than communicating with you about the payslip audit and providing the results. We will share your anonymised payslip with SafeRec. We may use your anonymised payslip and payslip audit results in furtherance of our work – for example to look for trends and patterns in umbrella company practices.

In all cases, before uploading your payslip, you must redact (cover or delete) any identifying information e.g. your name and address and umbrella’s name and address, as well as any sensitive or confidential information, such as your National Insurance number and bank account details. If you do not do this, we will delete the payslip immediately and will send you an email asking you to resubmit it.

If you have any questions about the payslip audit service, please contact us prior to uploading your payslip.

What do the results mean?

The payslip audit results are provided for information purposes only and should not be considered financial or legal advice. As set out above, we cannot guarantee the accuracy of the results. The results provide some guidance that may be helpful in understanding more about your payslip and may highlight areas that require some further checking or follow-up. The results do not provide a guarantee that your umbrella company is fully compliant with the law.

You should not act or refrain from acting based on the results without checking the full facts of your particular case with a tax, welfare rights adviser or other adviser such as a qualified legal professional as appropriate.

LITRG cannot comment on individual results or cases or get drawn into disputes. In particular, LITRG will never use results to challenge particular umbrella companies or divulge information to the authorities about particular umbrella companies. If the results highlight potential errors or discrepancies, you should seek clarity from your umbrella company in the first instance, as well as obtaining appropriate professional advice as detailed above. You may also want to read our website material which covers what to do if you find yourself in a non-compliant umbrella.

If you need professional advice, we recommend that you contact a tax adviser or if you are on a low income, one of the tax charities. See our getting help page for more details.