Self assessment tax payments

Self assessment payments are usually due by 31 January following the end of the tax year to which they relate. For example, tax due for the 2022/23 tax year is due for payment by 31 January 2024.

Content on this page:

Normal due date

Usually, self assessment payments (which can be made up of tax, class 2 and 4 National Insurance contributions (NIC) and student loan repayments) are due by 31 January following the end of the tax year to which they relate. For example, tax due for the 2023/24 tax year is due for payment by 31 January 2025. This is sometimes referred to as the ‘balancing payment’.

There is an exception where:

- you registered for self assessment on time (or otherwise notified HMRC on time that you owed tax for the year) – see Registering for self assessment, but

- HMRC did not give you a notice to file a tax return until after 31 October following the end of the tax year.

In this case, your self assessment balancing payment for the year is instead due three months after the date of the notice to file.

Payments on account

If you are self-employed, references to ‘income tax’ include class 4 NIC (where payable).

As well as a ‘balancing payment’ due for the previous tax year, some taxpayers also need to make instalment payments towards their annual self assessment bill for the following year. These are called payments on account.

Generally speaking, if you need to make payments on account, you will need to make payments on 31 July in each tax year as well as on 31 January.

You normally have to make a payment on account if your previous year’s income tax bill (excluding class 2 NIC, if applicable) was over £1,000, unless more than 80% of your previous year’s income tax was taken off at source.

Income tax will be taken at source if, for example:

- you are employed, in which case tax will probably be deducted through pay as you earn (PAYE) from your employment income, or

- if you are a self-employed subcontractor and come within the construction industry scheme (CIS), in which case you will probably have deductions of tax made by contractors from your invoices.

You may need to make payments on account for the first time if your tax bill is higher than it was previously.

It can be quite a shock to your cash flow when you first move to payments on account. It may help you to put aside a certain amount each time you get paid into a different bank account (see below under the heading Preparing for your tax bill).

If you prepare your tax return as soon as possible, it will give you more time to save up for both the tax which is due for that year and your payments on account for the following tax year.

How much to pay

The payments on account are based on your total income tax bill for the previous year (but excluding class 2 NIC, if applicable, if you are self-employed). So, if necessary, you must first deduct any class 2 NIC amount and if you need to make payments on account, each one will be half of this amount. They are due on:

- 31 January during the tax year, and

- 31 July following the tax year.

On 31 January, you also pay any balance of income tax due for the previous tax year (together with the class 2 NIC due for that year if you are self-employed). So, you may have two amounts to pay, being

- the balancing payment for the previous year, and

- the first payment on account for the current tax year.

However, you pay both together as a single total.

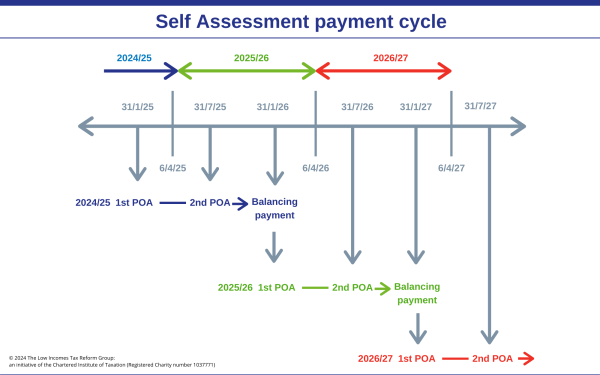

Therefore, if you are liable to payments on account, the typical payment cycle looks like this:

For an example of how payments on account work and guidance on how to budget for your tax bill, see Paying tax on self-employed profits and making payments on account.

Extra tax due following a tax return amendment

If HMRC make an amendment to your tax return, or you notify them of an amendment that will increase the tax due, any extra tax will be payable 30 days from the date of the amendment (although interest will run from the date that the tax should have been paid).

Reducing your payments on account

If you are self-employed, references to ‘income tax’ include class 4 NIC (where payable).

You can apply to reduce your payments on account if you think you are going to be paying more than you need to (that is, you think the next tax year’s bill will be lower than the one on which the payments on account are based).

You can do this at any time using form SA303 either online or in paper form up to when the balancing payment is due.

If you know you will need to reduce your payments on account for the next tax year when you are completing your tax return, you can also make the claim in the tax return form itself, giving details of the circumstances in the additional information pages of the return.

If you reduce your payments on account below what they should in fact have been (once the final liability is known), you will have to pay interest on the shortfall from the date each payment on account was due. In some cases, HMRC may charge a penalty if the reduction is excessive.

For an example of reducing payments on account, see our page Paying tax on self-employed profits and making payments on account.

Reducing your payments on account after paying them

If you have already paid payments on account, you can still reduce them by completing form SA303.

Any excess that you have paid can be refunded to you as long as it is at least 30 days until your next payment is due, or it can be held by HMRC and set against the next payment when it becomes due. If your next payment is due within 30 days, the refund will automatically be held and will be set against the next payment due.

Preparing for your tax bill

You might wish to put cash aside ready to pay your tax bill when it becomes due – for example, in a separate bank account.

You can also pay some or all of your tax in advance to HMRC, as explained below.

Budget payment plans (or ‘pay weekly or monthly’)

It is possible to pay your tax weekly or monthly in advance by direct debit, by setting up a budget payment plan with HMRC. This is optional and is different to making payments on account. The idea behind a budget payment plan is that you pay a regular amount to HMRC for a period of time before the payment deadline.

You can decide how much you pay under the plan – the idea is that you are putting aside a regular amount towards your tax bill. The payments made under the budget payment plan are then deducted from your final tax bill for the year.

If your tax bill is less that the total regular payments made under your budget payment plan, then you will need to pay the remaining balance by the normal payment deadline. If your final tax bill is less than the total tax paid under a budget payment plan, you will be entitled to a tax refund.

You can read more about how to set up a budget payment plan on GOV.UK . If you are thinking of setting up a budget payment plan but you make student loan repayments then you should read our guidance on how they interact with each other in our Student loan repayment page.

How to pay your tax bill

There are various ways to settle any payments due and these include cheque, bank transfer, debit card, but not personal credit card. See GOV.UK.

Make sure you have the correct reference number when you make any payment, so that HMRC correctly allocate it to your account. This will be your 10-digit UTR (unique taxpayer reference) number, usually followed by the letter K.

You will not automatically be issued with a payslip by HMRC in advance of the payment dates on 31 January and 31 July. If you do not receive a payslip, you should organise payment anyway otherwise you might incur a fine for late payment and not receiving a payslip from HMRC will not be accepted as a reasonable excuse for late payment.

If you are having difficulty meeting a tax bill or know that you will have difficulty paying a bill that becomes due in the near future, see Tax payment problems and debt.

Paying your self assessment bill via PAYE

Provided the amount you owe to HMRC by 31 January following the end of the tax year is less than £3,000, it may be collected via your pay as you earn (PAYE) code in the following tax year. This is known as ‘coding out’.

Class 2 NIC cannot be ‘coded out’ in this way and must be paid by 31 January following the end of the year. In addition, amounts cannot be coded out which would mean that more than 50% of your employee pay was collected for tax.

If you want to take this option, you will need to send in your tax return by 31 October on paper, or by 30 December if you are filing online. If you have filed within these time limits and the tax does not appear to be collected this way, you should contact HMRC to query this.