Tax return deadlines

To avoid being charged a late filing penalty, make sure you understand when your tax return should be filed.

Content on this page:

Due dates

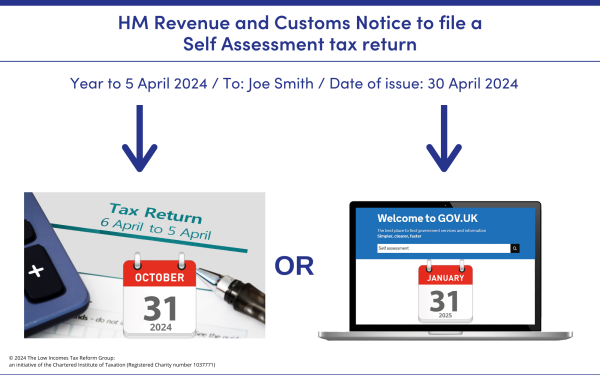

The due date for a self assessment tax return depends on:

- the date of issue of the notice that HMRC send you to tell you to complete a tax return, and

- whether you complete your tax return on paper or online.

The table below summarises the position for self assessment tax returns for 2023/24 (the tax year which ended on 5 April 2024):

| Date of tax return or date notice to file issued | Deadline for submitting paper return | Deadline for submitting return to HMRC to calculate tax (paper returns only) |

Deadline for submitting return online |

| On or before 31 July 2024 | 31 October 2024 | 31 October 2024 | 31 January 2025 |

| 1 August 2024 to 31 August 2024 | 3 months from date of notice | 31 October 2024 | 31 January 2025 |

| 1 September 2024 to 31 October 2024 | 3 months from date of notice | 2 months from date of notice | 31 January 2025 |

| After 31 October 2024 | 3 months from date of notice | 2 months from date of notice | 3 months from date of notice |

PAYE code adjustment for tax owed

If you owe less than £3,000 for the year and want HMRC to collect this by adjusting your PAYE code, you must submit a paper return by 31 October or an online return by 30 December following the end of the tax year. For 2023/24, this means submitting your online return by 30 December 2024 for the tax to be collected via your 2025/26 PAYE code. Note that the date is 30 December, not 31 December.

We explain more about paying self assessment tax via your PAYE code on our Self assessment tax payments page.

Penalties for late filing

If you do not submit your tax return by the due date, then (unless the new penalty system applies to you) you will automatically be charged a late filing penalty of £100. HMRC continue to charge penalties the longer you delay. See Tax penalties and interest for more details.

HMRC take the date of the first return received by them for the purposes of calculating late filing penalties. For example, if you file a paper return for 2023/24 after 31 October 2024, you cannot avoid a late filing penalty by filing the return online before 31 January 2025. However, if you intended to file on paper but miss the 31 October deadline, then you can avoid a penalty by filing the return online instead as long as you do so by the following 31 January.

Partnerships

If you are a partner in a partnership, note that HMRC do not provide an online partnership return. Therefore, if you want to file online you will need to file the partnership return by other means (such as via a tax adviser or using third party software). Otherwise, you must file a paper version of the return by the relevant paper due date to avoid late filing penalties in relation to the partnership tax return.

For more information on late filing penalties for partnerships, see HMRC’s manual.