Do you understand how income tax works?

A recent poll suggests a lot of adults in the UK do not understand how income tax works. It is important to know how income tax works, as it might affect decisions you make in relation to work or your finances. In this article we try to demystify income tax and how different rates apply to your income, making use of examples and a new graphic.

Content on this page:

Misunderstanding income tax rates and bands

According to a recent poll, many people think that once their income hits a higher tax rate band, all their income is taxed at that higher rate – but this is not the case! You can see the results of the poll on the Tax Policy Associates website.

Read on to learn how income tax rates and bands work for taxpayers who are resident in England, Northern Ireland and Wales. If you live in Scotland, please see our accompanying article for Scottish taxpayers.

How tax rates and bands work

The UK income tax system tries to ensure that as income increases, the rate of tax increases. This means that people with higher incomes pay a higher rate of tax on their extra income. This is known as a progressive system of income tax. There are some exceptions to this general rule, but we will not be looking at them in this article. For simplicity, the figures also look at income tax only and do not include National Insurance contributions (NIC). Although NICs are payable on earned income, they are calculated separately from income tax.

Income tax bands – slices of the pie

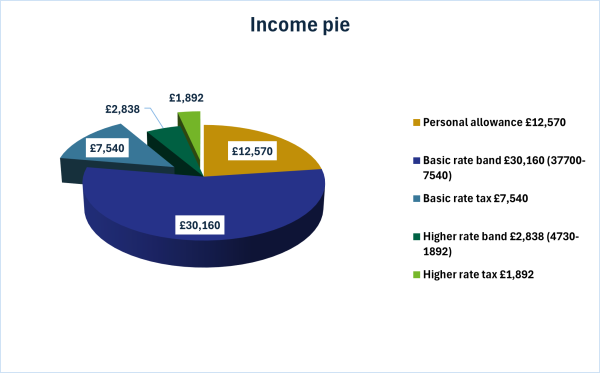

Income tax rates are calculated based on income bands. It might be helpful to think of these income bands as slices of a pie!

Let’s imagine that all the income you earn in a year is a pie. You have to give a slice of that pie to HMRC as income tax. The size of the slice you give to HMRC depends on how big your pie is.

Most people in the UK are entitled to a tax-free personal allowance. You can think of your personal allowance as the first slice of your income pie. You do not pay any tax on your taxable income that falls within the personal allowance. If your total income is less than your personal allowance, then your whole pie is free of income tax.

If your pie is bigger than £12,570, but no more than £50,270, then some of your income falls into a different slice. If you are a UK taxpayer, that slice is called the basic rate band. The UK basic rate band is £37,700. You usually pay income tax at 20% on income that falls within this slice of your pie.

If your pie is bigger than £50,270, but no more than £125,140, then some of your income falls into the next slice. This slice is called the higher rate band. You usually pay income tax at 40% on income that falls within this slice of your pie.

You do not pay tax at the higher rate on all your income. You only pay the higher rate on the portion of your income that falls within the higher rate band.

You can see the rates and bands of income tax on our web page Tax and NIC rates and bands.

So, let’s look at an example and see what that means in practice.

Marginal tax rates

You may come across the term marginal tax rate.

The marginal tax rate is the amount of additional tax you pay on every additional pound of income. It is often the same tax rate as the rate of tax for the highest tax band into which your income falls. However, because of quirks in the UK tax system, this may not always be the case. For example, if you pay the high income child benefit charge (HICBC), your marginal tax rate may be higher than the rate of tax for your highest tax band.

Why it matters

It is important to understand how tax rates and bands work, as this may affect some of the decisions you make.

For example, if you think that the higher tax rate will apply to all your income once you fall into that band, you may turn down opportunities, such as:

- a promotion at work

- overtime hours

- a second job

- offers of work if you are self-employed

If you understand correctly that it is only the part of your income that falls into the higher band that is taxed at that rate, then you can make informed decisions about taking on extra work or accepting a promotion.