Hiring a carer or personal assistant?

If you are hiring a carer or personal assistant, whether funded through government money, or privately, you can use our new flowchart to help you work out what, if anything, you need to do about tax. For example, if you are hiring someone and the nature of the arrangement is an ‘employment’ you will need to operate Pay As You Earn (PAYE) on their wages. It is important to get this right. Contrary to what you may understand or have been told, you cannot just pay your carer or personal assistant as though they are self-employed and think no more about it!

Content on this page:

Flowchart

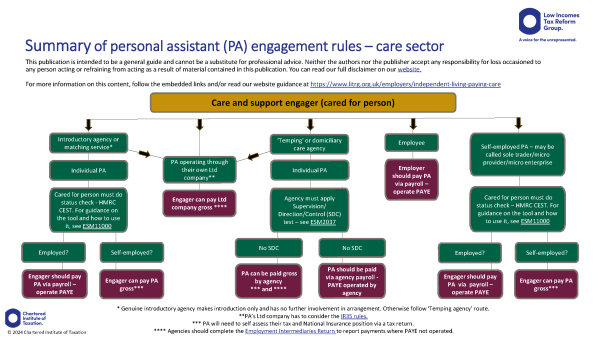

We know there can be lots of different entities involved in providing care. This means it can be complex to understand what all their different roles are and who should do what. As such, we have developed a flowchart setting out some common hiring scenarios in the care sector where someone is arranging their own care and support, rather than having it arranged by the local authority. The flowchart also shows which entity has the responsibility of checking a personal assistant’s employment status (that is, employed or self-employed) and the possible outcomes of each route.

Care and employer support flowchart

Employment status and tax

As you can see from the flowchart, if you take on a carer or personal assistant (PA) and they are not working through their own limited company or a temping agency, they will either be your employee or they will be self-employed for tax purposes. If they are your employee, you will need to operate PAYE on their wages. Their employment status depends on the reality of the working arrangements and nature of the relationship between you and them.

Some PAs may think of themselves as ‘self-employed’ and may say to you that they want to be hired on this basis. However, you must be very careful about accepting this ‘self-employment’ status at face value. This is even the case where:

- your PA doesn’t use the exact terminology ‘self-employed’ but says they are in business on their own account or something similar, or

- your PA has been ‘accredited’ as a self-employed PA, or

- an introductory agency proposes to provide you with a self-employed PA.

A PA or intermediary cannot make the decision about employment status in these circumstances. You have to decide the employment status of your PA – not them. And the consequences of getting it wrong in terms of being non-compliant with tax law and at financial risk could fall on you – not them.

But don’t panic. We have lots of information about how to check for yourself whether the person you are hiring is genuinely self-employed, or whether they are employed and you need to operate PAYE. You must do this check very carefully, by considering all the facts.

Guidance on status

The flowchart visually maps out the basic ‘rules of engagement’ when hiring a PA via a number of different routes. We have tried to ensure it is not too complex. However, for those that would like more detail there is specific guidance on the rules surrounding employment status from a care and support employer’s perspective in our guidance and factsheet.

In particular, you can find guidance around introductory agencies on our page on using a care agency. In our employing a carer section, we also cover what the rules are if you use an agency worker or ‘temp’, a family member or a carer who works through their own limited company.

Your flowchart says I have to operate PAYE – help!

If it turns out that your PA is your employee, this will bring with it many responsibilities such as registering as an employer with HM Revenue and Customs (HMRC), running a payroll, operating a PAYE scheme, arranging a workplace pension and paying at least the minimum wage.

It may seem like a daunting prospect, but our website guidance is intended to help those hiring someone understand and manage their employer responsibilities. Our guidance is particularly aimed at those who do not have an accountant or a payroll provider assisting them with their pay and tax responsibilities.

The rest of this article briefly explains some of the main considerations when employing a PA and highlights the guidance available from us in those areas. When taken together, it will hopefully provide you with sufficient background knowledge to help you feel confident in what you need to do and understand where to get further support if you need it.

- Setting up as an employer

-

If the PA you are hiring is an ‘employee’, the first step is probably to register as an employer with HMRC so that a PAYE scheme can be set up. The PAYE regime requires employers to deduct tax and National Insurance contributions (NIC) from most payments they make to employees.

You must register with HMRC as an employer (and operate a PAYE scheme) if any of the following are true:

- You are paying them at or above the National Insurance Lower Earnings Limit (£123 per week in 2024/25)

- The employee already has another job

- The employee is receiving a state, company or occupational pension

- The employee is receiving employee benefits

Registering with HMRC as an employer can be easier than it sounds. We provide step-by-step instructions in our guidance.

- Running a payroll

-

Our website also looks at what running a payroll involves. Basically, a payroll is the process by which an employer pays an employee’s wages and makes appropriate deductions (like PAYE tax and NIC). This sounds complex, but payroll software (see below) means that the required calculations can usually be done at the touch of a button.

Employers should give their employees payslips every payday. They must also complete certain forms after the end of the tax year for example, P60s or P11Ds (benefits and expenses form) – more information is available in the dedicated end of year process section of the website. If your employee leaves, you must give them a P45.

- Reporting information to HMRC

-

‘Real time information’ (RTI) is the system used for sending payroll information to HMRC – usually every payday.

There are two ways you can send the information – online, or, if certain requirements are met, by paper. Broadly, paper filing is available for those who, for whatever reason, may be unable to use a computer or have no internet capability.

For online filing, payroll information is submitted digitally to HMRC via payroll software. There are several options on the market including some free ones like HMRC’s Basic PAYE Tools (BPT), which is simple, secure and reliable. We explain the options further in our guidance.

- Paying HMRC

-

Every month or quarter (usually quarter for small employers), you must pay HMRC the amounts of tax and NIC you have deducted from your employee. We explain this process in our guidance. The good news is that because of the Employment Allowance, many small employers, including care and support employers, do not need to pay HMRC any employer’s National Insurance on top of the amounts deducted from employees.

- Pensions auto enrolment (workplace pensions)

-

Every employer with at least one member of staff has a responsibility to put those who meet certain criteria into a workplace pension scheme and contribute towards it. This includes those who hire a carer or personal assistant. Direct payment users should speak to their Local Authority (or NHS/DWP as appropriate) regarding their budget to pay for these extra costs.

The process is called automatic enrolment. This is because it is automatic for staff – they don't have to do anything to be enrolled into the pension scheme. But it is not automatic for an employer and there are several things that the employer has to do.

We summarise the main aspects of auto enrolment in our guidance (including how the auto enrolment rules apply to those with part-time or casual staff). We also link to more detailed guidance on The Pensions Regulator website, which includes their planning tool to help employers work out what to do and when.

- National minimum wage/national living wage

-

Employers must pay staff the correct minimum wage for their hours worked. They may also have to make payments to workers when they take annual leave, if they are sick or become a parent. Our section on pay and deductions gives an overview of the main rules.

We also look closely at aspects of minimum wage law that may be of particular relevance to those hiring a PA, for example, the rules on ‘live-in’ staff and travel time and deductions. These can be difficult for both workers and employers to understand.

- Other

-

Other useful resources include payroll checklists, a payroll calendar, and a payroll data card. We provide links to other information in areas outside of tax (for example employment law) and to more detailed, technical guidance on GOV.UK (which can sometimes be hard to find!) throughout.

Our website also contains a comprehensive section on dealing with HMRC if you have additional needs or need extra support.

How to give us feedback

If you have any comments about our flowchart or guidance, or have any suggestions about additional material that could be featured, please get in touch.