Warning: Tax scam letter

We have been made aware of a fraudulent letter being sent to individuals, supposedly from HMRC, asking them to send identification and business documents by email. We have checked with HMRC and this letter is a scam. Here we look at the ways you can protect yourself against this scam, and the important things to check to satisfy yourself that a letter from HMRC is genuine.

Content on this page:

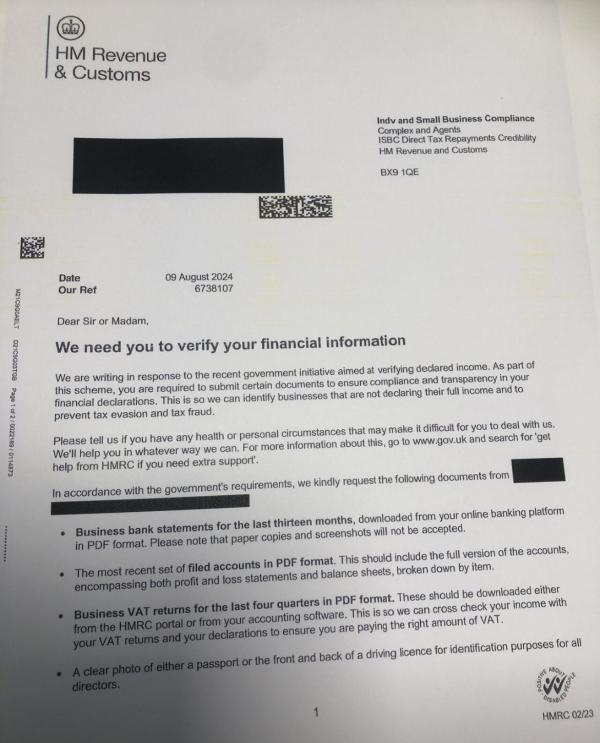

Last week, accountancy firm Azets posted a copy of a fraudulent letter received by one of their clients on social media. The letter is very convincing in making the individual think it is a genuine HMRC letter – but we have checked with HMRC who have confirmed it is a scam.

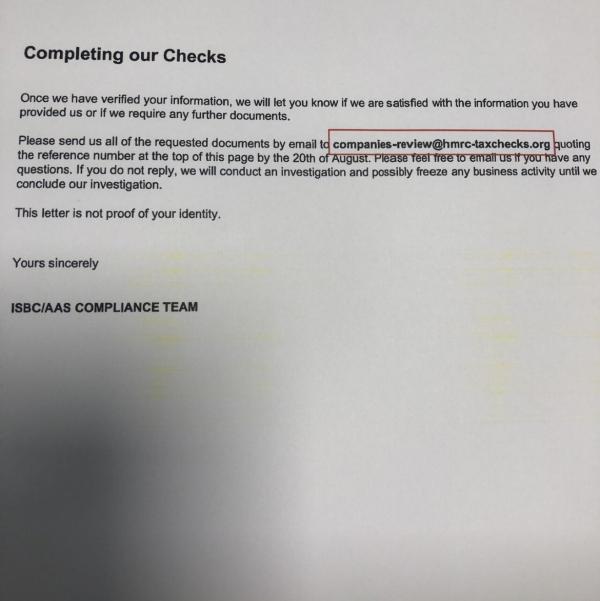

The main indication that the letter is a scam is that the email address is not a genuine HMRC address.

HMRC email addresses will always end with hmrc.gov.uk. If you ever receive a letter or email saying it is from HMRC, asking that you send information to an email address not ending in hmrc.gov.uk, then it is almost certainly a scam.

I received this letter and sent my details to the email address – what should I do?

If you received this scam letter and sent personal details to the email address in the letter then you should do the following:

- Contact the HMRC security team via email [email protected] Include brief details of the type of information you disclosed (for example name, address, HMRC user ID etc.) but do not give your actual personal details in the email.

- You should also contact Action Fraud if you are in England, Wales or Northern Ireland. In Scotland you can report it to Police Scotland by calling 101.

What should I do if I receive a letter from HMRC?

If you receive a letter that appears to be from HMRC, you should always check it carefully before responding. This is especially important if the letter is asking you to make a payment or send personal information or documents. You can go to the GOV.UK website and check if the letter is listed as a genuine letter. If in any doubt, contact HMRC via webchat or phone to confirm the letter is genuine. Use the contact details on GOV.UK, rather than those given on the letter.

What should I do if I receive an email, text or phone call from HMRC?

Unfortunately, there are lots of tax related scams – some are sent by email, others by text message or even through phone calls. They range from someone calling you to say you will be arrested for an outstanding tax bill if you don’t pay immediately through to tax refund scams – promising you a tax refund if you provide your bank details.

HMRC do send text messages, emails and letters, so it won’t always be the case that the communication you receive is a scam, but it is important to always check that what you have received is genuine before responding.

Don’t give out private information such as bank details or passwords, reply to text messages, download attachments or click on any links in emails without checking they are genuine.

How can I recognise a scam?

HMRC say it could be a scam if it is:

- unexpected

- threatening

- rushes you

- asks for personal information like bank details

- tells you to transfer money

- offers a refund, rebate or grant, but does not properly explain why (for example, if you are due a tax refund, it should provide a calculation to show why the refund has arisen).

You can see examples of tax scams on GOV.UK.

What do HMRC say about these scams?

HMRC asked us to share this message on their behalf:

Criminals are great pretenders. They use various methods to try and dupe citizens, and often mimic government messages to make them appear authentic.

Tax scams come in many forms. Some offer a rebate, others tell you that your tax details are out of date, or threaten immediate arrest for tax evasion. Never let yourself be rushed. If someone contacts you saying they’re HMRC, wanting you to urgently transfer money or give personal information, be on your guard. We will also never ring up threatening arrest. Only criminals do that.

Unexpected contacts like these should set alarm bells ringing, so take your time and check HMRC scams advice on GOV.UK

HMRC provided the following advice:

Protect

- Criminals are cunning - protect your information.

- Take a moment to think before parting with your money or information.

- Use strong and different passwords on all your accounts so criminals are less able to target you.

Recognise

- If a phone call, text, letter or email is suspicious or unexpected, don’t give out private information or reply, and don’t download attachments or click on links.

- Check on GOV.UK that the contact is genuinely from HMRC.

- Do not trust caller ID on phones. Numbers can be spoofed.

Report

- If you’re unsure about a text claiming to be from HMRC forward it to 60599, or report a letter or email to [email protected]. Report a tax scam phone call on GOV.UK.

- Contact your bank immediately if you’ve had money stolen, and report it to Action Fraud. In Scotland, contact the police on 101.

- By reporting phishing emails, you help stop criminal activity and prevent other people falling victim.