Limited companies

Limited companies are cheap and easy to set up. But working through your own limited company is very different from just being an employee or self-employed or working through an agency or umbrella company. You therefore need to consider all the factors before deciding to set one up (or allowing one to be set up for you).

Content on this page:

Introduction

A limited company is a way of running a business. But it is not the only way – you can also run a business as a ‘sole trader’, for example, which is an individual in business on their own account. Or you could be in partnership with others, where several individuals who are the ‘partners’ run the business together.

Sometimes you may not really consider that you have your own ‘business’ at all but may still be asked to work through your own limited company by an intermediary in the temporary employment industry, like an agency or umbrella company (see heading below ‘Lower paid agency workers’). In this situation, the services you provide when you are on an assignment could be thought of as the ‘business’ of your limited company.

A company is a legal entity in its own right and must be registered at Companies House. It is owned by its shareholders, who own shares in the company.

A company will usually be run by at least one director. If you work through your own limited company, you will probably be both the director and the sole shareholder. You should be very wary if someone sets up a limited company for you with other directors and shareholders as well as you.

You can find more information on setting up a limited company on GOV.UK.

Whether to have a limited company

If you are starting out, you should not be swayed by people telling you that you have to have a limited company to run a business or that a limited company is more tax efficient than being a sole trader.

Running a limited company is not straightforward. In some cases, due to the administrative requirements, a company is not a suitable way for new businesses to trade at all, particularly if there is only modest income involved. It is important you understand what it means to set up a limited company and whether that is the right thing for you and your business. It can be an expensive mistake if you then have to pay someone to close it down for you (and deal with any compliance issues that have cropped up in between).

We know from the number of people who write into us asking for help with their limited company problems that this is a significant issue, and many people wish they had never got involved with setting up a limited company. Although for some people it will be the right choice, it is really important to do your own homework and come to an informed decision yourself.

If you are not sure that running a limited company is for you at this time, then you should understand that is possible to start your business off as a sole trader (i.e. self-employed), and then turn your business into a limited company at a later date.

You can find an overview of the advantages and disadvantages to running a limited company in comparison to being a sole trader in this briefing note written by our colleagues in the ATT.

Self-employed to company director

Company directors are not self-employed. There is long standing confusion about the difference between self-employment and being a director of a limited company.

When someone has been working on a self-employed basis (that is, as a sole trader) and their business begins to develop, the next step can often be to incorporate and provide their services via a limited company. Once someone begins to work through their own company, they are no longer self-employed, even though they may carry on doing the work in a similar way to the way they have always done.

This means that once you have a limited company, you cannot simply think of your company’s money as your own as you may have done with your business’ money when you were self-employed. You also cannot simply declare your company’s money on your next personal tax return in the same way you would have declared your self-employed earnings. The money belongs to your company – not you – and that changes everything!

For more about how company directors should pay themselves, see ‘How your company pays you’ below.

Confusingly, for universal credit (UC) purposes, there is a look through the limited structure and directors of their own companies are usually treated as self-employed. UC is different in this respect to legacy benefits and income tax. We explain more on our specialist website.

Reasons to have a limited company

There are many reasons why a business may operate as a limited company. These include:

- The ‘limited liability’ protection. The ‘limited’ bit of a limited company means that, in most cases, you should not be personally liable for any financial losses made by the business (as compared to a sole trader who could be liable for the debts of their business to the full extent of their personal assets). But if you have no private assets to protect or are unlikely to be taking big risks or building up big debts, then this may not be a significant benefit to you.

- Having a limited company can help present a professional image, which may be important if you have a business that you want to develop and grow.

- You may have lower overall tax and National Insurance (NIC) costs. This is usually because you will receive income from the company in both salary and dividend form and dividend income is taxed more favourably than salary as it is not liable to NIC. Also, corporation tax rates for small companies are generally lower than most income tax rates (more on this below). There can be some disadvantages to receiving money from the company as dividends rather than wages or salary. Dividends are regarded as investment income and not employment income– for example, they were not recognised as ‘pay’ for the purpose of the Coronavirus Job Retention Scheme during the pandemic, which meant that support grants for directors were limited.

- Some clients may require you to work through an intermediary such as a limited company or an umbrella company, as this saves them money (there are no employer costs such as employer NIC when paying a company and no PAYE obligations). They may also be hesitant to work with someone who is just a sole trader, as HMRC may do a PAYE enquiry and find that you should have been treated as an employee. Having an intermediary (such as a limited company or an umbrella company) between them and you provides them with protection against this.

Lower paid agency workers

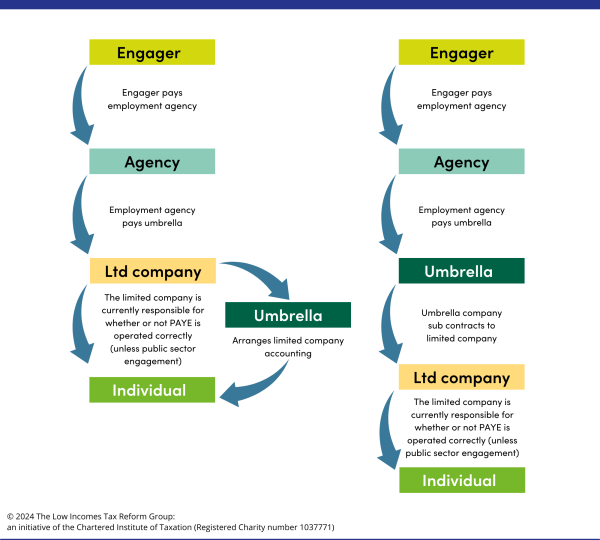

Historically, some lower paid agency workers have been encouraged into or put into limited companies by agencies/umbrella companies, typically in one of two ways:

The driving force behind having a limited company at some point in an agency worker supply chain, is usually to increase profit/reduce obligations on behalf of another entity in the chain. If an agency or umbrella pays a limited company rather than a worker, then it is a business-to-business transaction and they do not have any ‘employer’ costs or responsibilities, which can save them money (which may then be shared through the supply chain). There can also be an additional revenue stream created, from the fact that most workers in limited companies will need help from an accountant with running the limited company and so can be charged for this service.

If you work through an agency or umbrella company and aren’t sure if you have a limited company set up, you should double check with the agency or umbrella company. You could also search for your name at Companies House .

Main legal requirements

People who have their own limited company will be a director of their company and generally also:

- the shareholder of the company, and

- the employee of the company.

Each year, your company will need to:

- file annual accounts and an annual confirmation statement with Companies House

- submit a company tax return to HMRC

- pay any corporation tax it owes on its profits

- keep detailed financial records of the business’ day to day activities

As a director/shareholder, you will probably need to prepare a self assessment tax return in your personal capacity each year.

As we explain in ‘How your company pays you’ below, to the extent that directors/employees get a salary from their own limited company, this should be paid via the pay as you earn (PAYE) system.

You will also need to keep an eye on the level of the limited company’s business income and regularly check to see whether the company needs to register for VAT, as the VAT regime applies to all businesses including companies.

In addition to all the admin, there are many rules about the duties of directors, and their actions are subject to scrutiny by the courts. For example, as a director of a limited company, you must try to make the company a success, using your skills, experience and judgment and follow the company’s rules shown in its articles of association (the companies’ internal rulebook).

You can find more information on director's responsibilities on GOV.UK.

Stooge directors

We have heard of individuals being recruited via social media to act as stooge directors to front umbrella companies that are not compliant with tax law. Becoming a director is definitely not something to be undertaken lightly and you may be fined, prosecuted or disqualified from being a company director in future if you do not meet your responsibilities.

We set out the associated risks in more detail in our press release linked to in ‘You might also like’ below.

How your company pays you

As we explain above under the heading ‘Self-employed to company director’, if your company is hired to do some work which you carry out on behalf of the company then this is not being done on a self-employed basis. This means you cannot just pay yourself wages without having to worry about PAYE.

If you work through your own limited company, the limited company will be hired to do the work (either directly or via an intermediary like an agency/umbrella company), and then you, generally* as an employee of the company, will carry out the work on behalf of the company. Invoices for your services will be issued by the limited company, not you. Money coming in will belong to the company rather than you and should be paid into the company’s bank account and not your personal bank account.

Directors are ‘office holders’ which means that any money paid to you by the company relating to your directorial duties should be subject to PAYE.

As an employee of the limited company, the company will probably pay you a small salary (to make use of the tax and National Insurance thresholds). The limited company will usually need to register as an employer with HMRC and take income tax and NIC from your salary under the PAYE system, depending on the level of salary paid.

(*Note that for company work not related to the role of director, in theory, it may be possible for you to do this on a self-employed basis, by being hired by your own company to carry out the work on its behalf. But this would only usually happen if you had some real specialist skill unrelated to the company's normal business and you provide this to other businesses as well as your own, for example. This would be very unusual, particularly for those on relatively modest incomes, therefore we do not consider the possibility any further in our guidance.)

The limited company profits, that is the remainder of the money paid to the company (after deducting your salary, any other business expenses such as travel, telephone etc. and also the corporation tax due, if any), will probably be paid out to you as a dividend. A ‘dividend’ is an income payment a company can make to its shareholders if it has made a profit. If there other shareholders they should be paid a dividend too. There are formalities to observe when paying out a dividend (or extracting money in other ways from your company).

If a dividend is not paid out, then the money can be used to reinvest in the business.

If you are a contractor with a limited company, then the IR35 rules/off payroll rules (see the heading below ‘IR35/off-payroll working’) may cause some confusion as to whether you are self-employed. These rules are very complex but basically say that if a director looks like an employee of the end client they work for, but for their limited company, then they should pay the same level of tax/NIC as an ordinary employee.

You can fall outside of these rules if you look like a self-employed person working for the end client rather than an employee (as per the general status tests). But this ‘self-employed’ determination only applies for the purpose of deciding whether IR35/the off-payroll rules apply. It does not change the actual position of the individual as regards the nature of the income paid out to them by their limited company - it would still be salary/dividends etc.

Using an accountant

If you are running a Ltd company, it is very likely that you will need some professional help with your corporate tax affairs and personal tax position. We tell you how you can find a tax adviser in our getting help with tax pages.

Even if you pay someone to do all the administration for you, as a company director you are ultimately responsible for ensuring that it is correct.

There may be significant costs involved in using an accountant and this can substantially reduce any financial benefit of trading as a limited company (see ‘Reasons to have a limited company’ above). Therefore, you should make sure that you understand the basis on which fees will be calculated and what they will cover. In particular, make sure you understand if there are penalties if you sign up to pay for a ‘package’ of services on an ongoing basis, but want to leave early.

Many people call themselves ‘accountants’ but they may not actually have any professional qualifications. It is vital that you take care when choosing an accountant, as we have occasionally heard of some poor practices, for example, failure to respond to contact, failure to produce accurate accounts/tax/VAT returns, failure to submit accounts/tax/VAT returns to the appropriate authorities on time or at all, not returning paperwork, acting in conflict of interest, and failing to maintain confidentiality. All of these things can mean a relationship can quickly break down and you are left without any support.

If you are asked to work through a limited company by an agency or umbrella company, you may find that they arrange limited company accountancy services for you, and so you do not get to choose the accountant yourself. You should still make sure that you understand whether the accountants are suitably qualified and what the fee arrangements are.

IR35/off-payroll working

If your limited company supplies your services, then in certain circumstances you will have to consider the impact of the intermediaries’ legislation, also known as IR35/the ‘off payroll’ legislation.

We look in more detail at these rules on our page for contractors.

Closing down a limited company

This depends on whether the limited company you have set up has ever actively traded. If a limited company has never actually traded in reality (that is, it has never issued an invoice and has never received any income into its bank account), then you should apply to strike off the company from the Companies Register by completing a form.

You should send a copy to HMRC with a covering letter explaining that the company has never traded and request that HMRC close down the corporation tax record.

In any other case, you need to take the appropriate steps to ensure that the limited company is closed down properly otherwise you could be left with messy limited company and corporation tax compliance issues that could follow you around for years.

If you are paying for accountancy services, you should be aware that they may not be prepared to deal with closing down your limited company as part of their normal fee.

If you try to deal with things yourself and get stuck (for example, because there are outstanding corporation tax (or VAT or PAYE) issues which mean HMRC object to the striking off) but cannot afford to pay accountancy fees, the tax charity TaxAid may be able to offer you basic telephone help/support. HMRC’s Extra Support team may be able to help you with any outstanding corporation tax (or VAT or PAYE) requirements but will be unable to deal with Companies House. You can read about how to contact the Extra Support team on our website.