Capital gains tax

Capital gains tax (CGT) is a complicated subject, so we provide an introduction only. We do cover the main issues, though, and signpost you to where you may find extra help.

Content on this page:

Overview

CGT is a tax charged if you sell, give away, exchange or otherwise dispose of an asset and make a profit or 'gain'.

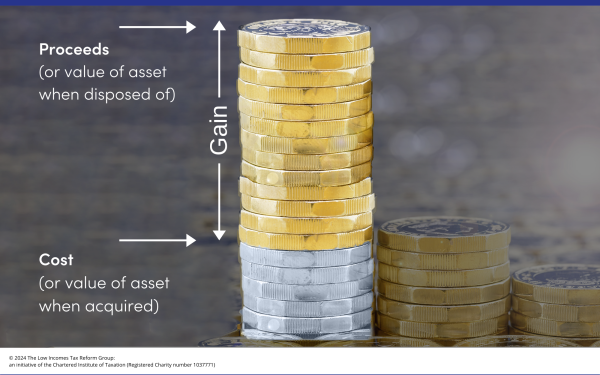

It is not the amount of money you receive for the asset but the gain you make that is taxed.

Broadly, to calculate the gain, you compare the sale proceeds (or value of the asset at the time it was disposed of) with the original cost of the asset (or value when it was acquired). This is illustrated below:

You can find a basic guide to CGT on GOV.UK.

When it applies

As noted above, CGT applies when you sell, give away, exchange or otherwise dispose of a capital asset. A capital asset is something that you own such as a house, shares in companies or other possessions.

Some assets are specifically exempt from CGT. We discuss exempt assets below.

If you are a UK resident, you may be liable to CGT on disposals of assets located anywhere in the world, not just your UK-located assets.

Non-residents are liable to CGT if they are carrying on a trade in the UK. If you are non-resident (including in the overseas part of a split year), you may also be liable to CGT on the disposal of UK land and property (although main residence relief may apply).

There are special rules for CGT purposes that apply to individuals who are normally resident in the UK but are temporarily resident outside the UK (broadly this means those who are non-resident in the UK for less than five years). We look at these on our page Non-residents and capital gains tax.

You may have to pay CGT when you give an asset as a gift to someone.

The rules are different depending on who you give the gift to and there are special reliefs for gifts of business assets. We do not cover the relief for gifts of business assets here, but you can find information on GOV.UK.

CGT can also apply if you transfer assets on separation, divorce or dissolution of a civil partnership.

In some cases, you are treated as if you have disposed of an asset. This might happen, for example, if a personal possession, such as an antique, has been destroyed and you have received a capital sum, such as an insurance pay-out, by way of compensation.

Inherited assets

You do not pay CGT when you inherit an asset, but you may have to pay CGT if you sell, give away or exchange an asset you inherited and it has increased in value since the date of death.

If the asset you inherited increases in value between the date of the deceased's death and the date you dispose of it, the increase is a capital gain.

Exempt assets

As already mentioned, some assets are specifically exempt from CGT. Some of the most common examples are:

- private motor cars, including vintage cars

- gifts to UK registered charities

- some government securities

- prizes and betting winnings

- cash

- stocks and shares held in an ISA

- foreign currency held for your own use

The disposal of your main home is often free of CGT, but this is not always the case. The CGT relief that can be applied on disposal of your main home does not apply to second homes or properties which are rented out, though part of those gains might qualify for relief if the property has previously been your only or main residence. You can read more about the relief on our page Selling your home.

If you sell or give away personal belongings (‘chattels’) then there will be no CGT if your share of the proceeds or value when given away is less than £6,000. See Selling shares and other assets for more information. Please note, however, that company shares are not usually exempt from CGT.

Calculating gains

You normally work out your gain by taking the proceeds (or in some cases, the market value on the date of disposal) and then deducting all of the following:

- original cost (or in some cases, market value when acquired)

- incidental costs of purchase

- costs incurred in improving the asset

- incidental costs of sale

This then gives you the chargeable gain.

Proceeds and costs

In terms of proceeds, if you give away an asset HMRC will treat you as having sold it for what it is worth (that is, the market value).

In terms of costs, if you bought the asset, you would normally use the actual amount paid for the asset as your ‘original cost’. However, if you are selling an asset you owned at 31 March 1982, you use the market value as it was on 31 March 1982 – the amount you could have sold it for on the open market at that date – instead of your original cost.

If the asset was received as a gift, you will usually need to consider the market value of the asset when you acquired it (unless, for example, you acquired it from your spouse or civil partner – in which case, you would usually use their purchase cost or value when they acquired it – see our information on our page Capital gains tax on gifts).

When you improve or add to your asset, you can deduct this cost in the calculation (this will reduce the gain). You can only include improvements, for example, an extension to a house, and not repairs.

Similarly, you can deduct the incidental costs of buying and selling in the calculation. Typical costs include legal expenses and estate agents' fees for property, and broker's commission on the purchase and sale of shares.

We discuss these elements further under Capital gains tax reporting and Capital gains tax record-keeping.

Part disposals

Where you dispose of only part of an asset (other than shares – see our separate guidance), you work out your cost by taking your sale proceeds and dividing them by the total of sale proceeds and the market value of the unsold part. This is then multiplied by your overall cost like this:

Cost of the part disposed of = A x B/C, where

A = overall cost

B = sale proceeds

C = sale proceeds added to the market value of the unsold part

Small part disposals of land

If you sell part of a holding of land for £20,000 or less and the proceeds are not more than 20% (1/5th) of the value of the whole piece of land, you can elect not to have made a disposal; but the amount of proceeds you receive is taken off your cost which is used to calculate any future disposal.

You cannot make the election if you have other disposals of land in the same year and the total of proceeds for all disposals is more than £20,000.

See HMRC’s capital gains manual CG71870 for more information.

The annual exempt amount

Each tax year, most individuals who are resident in the UK are allowed to make a certain amount of capital gains before they have to pay CGT. This is because they are entitled to an annual tax-free allowance, called the annual exempt amount (AEA). It is also sometimes referred to as the annual exemption.

The AEA has reduced in recent years:

| Tax year | AEA |

| From 2024/25 | £3,000 |

| 2023/24 | £6,000 |

| 2022/23 | £12,300 |

Any unused AEA cannot be carried forward or back. Each spouse or civil partner gets their own AEA.

Individuals who are resident in the UK, but not domiciled here, and who use the remittance basis of taxation (other than in the case where the remittance basis applies automatically because unremitted foreign income and gains are less than £2,000) are not entitled to an AEA.

Individuals who are non-resident who may be liable to CGT on the disposal of UK land and property are entitled to an AEA.

Rates of CGT

In 2024/25, the rate of CGT you pay can vary between 10% and 28%, depending on:

- what type of chargeable asset you have disposed of,

- when you disposed of the asset,

- the tax band into which the gain falls when it is added to your taxable income, and

- whether you qualify for business asset disposal relief.

Rates of CGT are the same across the whole of the UK. Scottish and Welsh taxpayer status is ignored.

The rate of capital gains tax which applies to a gain made on the disposal of an asset, depends on how much of your basic rate band is available after your income has been charged to tax.

Rates for disposals of residential property

|

2022/23 |

2023/24 |

2024/25 |

|

| Rate for gains which fall within basic rate band when added to other taxable income |

18% |

18% |

18% |

| Rate which otherwise applies |

28% |

28% |

24% |

Rates for disposals of other assets1

For 2024/25, there are two sets of rates depending on when the disposal took place.

|

2022/23 |

2023/24 |

2024/25 |

2024/25 |

|

| Rate for gains which fall within basic rate band when added to other taxable income |

10% |

10% |

10% |

18% |

| Rate which otherwise applies |

20% |

20% |

20% |

24% |

1 Except carried interest gains and gains qualifying for business asset disposal relief. See GOV.UK.

2 As announced in Autumn Budget 2024.

Note: If you have disposed of more than one type of asset in the year and none of these disposals qualifies for business asset disposal relief, then you may choose which gain uses any remaining basic rate band. However, if you have a gain which qualifies for business asset disposal relief, then this must use any remaining basic rate band in priority to other types of gain.

Welsh and Scottish taxpayers

If you live in Scotland and are a Scottish taxpayer, or in Wales and are a Welsh taxpayer, the same rules as explained above apply to you. You must consider your total income and gains in relation to the UK rates and bands to work out your CGT, even if you pay income tax at the Scottish or Welsh rates and bands on your salary, self-employed profits, rental income or pension.

Jointly-owned assets

Each of you is usually liable to tax on your half of any gain arising, assuming the asset is owned equally. If it is not, you are each assessed to tax based on your share of the asset. You can read more about jointly-owned property generally on our page Joint income from property.

Date of disposal

The date of disposal for CGT is the date that you enter into an unconditional contract (though see below for unconditional but uncompleted contracts as at 30 October 2024).

This means that for property, this is the date that contracts are exchanged and not the date of completion when possession of the property is actually taken.

However, note that there is a 60-day window for reporting any capital gains tax due on disposals of UK residential property (or, if you are non-resident, for reporting all disposals of UK land or property). This begins from the date of completion.

For shares, it is the date the bargain actually took place and not the date of the contract note or the date of settlement.

If, instead, you enter a conditional contract, the relevant date is the date when the conditions are satisfied. Let’s say, for example, someone agreed to buy a house that you own on the condition that the broken-down central heating boiler is replaced. The terms of that work might be set out in an agreed contract. The disposal date for the house for CGT purposes would be when the work was agreed to have been completed to the terms of the contract, not the date the contract was agreed.

For 2024/25, if you entered into an unconditional contract prior to 30 October 2024 for the disposal of an asset other than UK residential property, but the contract was not completed by that date, then the post-30 October 2024 rates might apply. See GOV.UK for more information.

Delayed or deferred sale proceeds

When you sell an asset, sometimes you receive only part of the money at the date of sale. You may receive further amounts later and some may be dependent on future events. This is called deferred consideration.

Depending on the type of deferred consideration involved, you may need to take it into account immediately when working out your gain or loss for the disposal even though you do not receive it until sometime later.

Generally, if you know the amount of money that you will be receiving, even if it is not payable until a later time, then you include it when calculating the gain or loss.

For example, if the deferred amount consists of an immediate payment followed by a number of instalments, the figure of total proceeds is known in the year of disposal and should be included in your CGT computation even though the actual money will not be received until later.

We are not going to look here at the situation where the amount of the deferred payment is not known as this is more complicated and may require a valuation of the deferred amounts.

Where the disposal proceeds for an asset are payable to you by instalments, you may, in certain circumstances, ask HMRC if you can pay any CGT due by instalments (in recognition that you may not have the money to pay the CGT otherwise).

This relief is available where the instalments, as set out in the contract for sale of the asset:

- begin no earlier than the date of disposal of the asset,

- extend over a period exceeding 18 months, and

- continue beyond the date on which the tax would otherwise be due and payable.

HMRC guidance states that such an application must be made in writing to them. See their capital gains manual CG14910 and self assessment manual SAM80072.

Further information

You can find a collection of information on CGT on GOV.UK.

For HMRC’s detailed and technical CGT information see the CGT manual.

You may need professional advice when disposing of assets, as CGT can be complicated. Other taxes, such as stamp duty, stamp duty land tax (and similar taxes in the devolved parts of the UK) might also apply on the transfer of property. Giving assets away can also have inheritance tax consequences. Our Getting help pages give guidance on finding a tax adviser.