Selling your home

Normally, if you sell (or otherwise dispose of – for example, if you give away) your only or main home, you do not have to pay capital gains tax (CGT) on any profit if it has been your only or main home throughout the entire period of ownership. This is called main residence relief (or private residence relief). It can also apply in part to gains on the sale of a property which was not always used as your only or main home.

Content on this page:

Meaning of ‘only or main home’

For CGT purposes, a home can also be called a residence or private residence. The three terms are interchangeable and refer to any dwelling-house which you use as a residence – in simple terms, it is somewhere you live.

It is not sufficient that the dwelling-house is capable of being occupied as a residence, or even that it is occupied as a residence by someone else (though see below regarding married couples and civil partners). You must occupy the dwelling-house as a residence, or be deemed to occupy it as a residence, for it to be your residence for CGT purposes.

It is possible to have more than one home (or residence) at the same time – for example, where you split your life across two locations and you occupy each property as a residence simultaneously. In some cases, you can be deemed to occupy a dwelling-house as a residence for a period.

These rules apply equally to houseboats and residential caravans. A garden area of up to half a hectare is included as part of your home, or a larger area if the property requires it.

If you have more than one home for a period of time, including those which you are deemed to occupy as a residence, then you need to understand which is your main home (or main residence) for that period. For CGT purposes, this is sometimes referred to as your principal private residence (PPR).

Whether or not a property is your home as a question of fact depends on how you use it. This can change over time. For example, if you let out a whole property which used to be your home, then it will no longer be treated as your home as a question of fact for the period during which it is let (though it may be deemed to be occupied as a residence, under separate rules – see below). This is important as the CGT consequences on disposal depend on how the property was used over the period of ownership.

If you dispose of a property which has been used as your only or main home at some point in the period of ownership, the disposal will attract some amount of main residence relief.

In the simplest case, if you dispose of a property which has been used as your only or main home throughout the entire period of ownership, then it will qualify for full relief.

Spouses and civil partners

You and your spouse or civil partner can only have one main residence between you whilst you are 'living together'. Unless you are separated, you are deemed to be living together even if your spouse or civil partner is working away from ‘home’. This includes situations where one person is living and working overseas for a period of time.

The position on permanent separation when a marriage or civil partnership breaks down is set out in this HMRC guidance. If you have not separated under a court order or formal deed of separation, the question is whether you have separated “in such circumstances that the separation is likely to be permanent”. Following such a separation, a married couple or civil partners can have different main residences. We explain the CGT consequences of a relationship breakdown at Capital gains tax on separation and divorce.

If you have a partner (who is not your spouse or civil partner) and you each own a home, you can each potentially get main residence relief on your respective properties for the same period. However, for this to apply you would each need to use your own property as a main residence – that is, you live separately. A main residence nomination (see below) may be advisable if, based on the facts, although you each use your own property as a residence, you both live together in one of the two properties as a main residence. Otherwise, the relief might be denied on the other residence.

If you move in together into one of your homes and the other partner lets theirs out, then read our further guidance below on calculating any gain on disposal of the property which is no longer lived in.

Rental properties

If you live in a property which you rent but do not own, this can still be a residence for main residence relief purposes.

You might wonder why this matters – you cannot sell a property you do not own and therefore will not ever make a capital gain on it. Usually it will not matter, but the point is important if you have another property that you own which also qualifies as a residence. In this instance, the availability of main residence relief might be denied on the property you own if, based on the facts, the rental property is your ‘main’ residence. We discuss this more below.

Main residence nominations

If you have more than one residence at the same time (whether rented or owned, and whether actually occupied or deemed to be occupied as a residence – we discuss deemed occupation later in this page), then you may declare which of these properties you wish to treat as your ‘main’ residence for CGT purposes.

A nomination can be made in respect of any residence, even if it would not otherwise be considered your ‘main’ residence. However, it must be a property that is used as one of your residences (or deemed to be occupied as a residence). If you do not make such a nomination, the question of which property is your ‘main’ residence will be decided based on the facts.

Any nomination must usually be made within two years of any change in the combination of your residences. If no election is made, then your main residence will be a question of fact.

As mentioned, it is usually necessary for a main residence nomination to be made within two years of a change in the combination of your residences. However, if all but one of your residences has a negligible capital value (for example, a rented property), then the two-year time limit does not apply. In either case, you should advise HMRC of your decision in writing. Nominations affecting both spouses or civil partners must be given by both parties. Further information on how to make the nomination is available on GOV.UK.

Main residence nominations can be a complicated area. You need to bear in mind that if you nominate a property to be your main residence, then any other property would no longer qualify for full main residence relief on sale.

If you have more than one property that could qualify as a ‘residence’ at the same time, you should seek advice about whether a main residence nomination should be made based on your circumstances.

Properties that have not always been your main home

There are special rules where you dispose of a property which has not always been your main home.

Broadly, the following periods are fully relieved from tax as long as you lived in the property as your only or main home at some point:

- any period when you lived there and it was your only or main residence as a question or fact

- any period where a valid nomination has been made for that property to be treated as your main residence

- the last 9 months of ownership (this may be extended to 36 months if you, or your spouse/civil partner, are disabled or you move to a long-term care home – see below)

- the initial period of ownership during which the property was not your or anyone else’s residence, provided that you moved in within 24 months of acquiring the property and during that period either the construction, renovation, redecoration or alteration of the property was being completed, or you had sold a property which was (at the time of sale) your main home

Deemed occupation

In certain circumstances, if you are absent for a period from a property which has been your main residence, it may nevertheless deemed to be occupied as a residence during that period. This means that these periods may also qualify for main residence relief if you had no other residence at the time.

The following absences may qualify as a period of deemed occupation:

- Any absence up to a maximum of three years (this may be one absence or a series of absences which total three years).

- Any absence where throughout that absence you were employed overseas and all your duties were performed overseas.

- Any absence up to a maximum of four years (this may be one absence or a series of absences up to four years maximum) where, broadly, either (a) you worked (including self-employed work) too far from the property to use it as your home, or (b) you were required by your employer to live somewhere else.

In general, the rules require that you lived in the property as your only or main home at some time both before and after the period of absence. However, if you are unable to return to live in the property because of work restrictions after one of the work-related absences above (2 and 3), you can still count the period as a period of occupation.

The above rules only treat the property as being occupied as a residence – not necessarily as a main residence. Therefore, if you have another residence during the period (whether owned or rented) and you wish to secure main residence relief on the property from which you are absent, it is recommended to make a nomination to HMRC confirming that you wish to treat that property as your main residence during the period. If you do not make such a nomination, the question of which property was your main residence will be decided on the facts.

Note that periods spent living in ‘job-related accommodation’ can also qualify for relief – see below.

You can also read more on GOV.UK.

Homes used for business

If you run a business from home, you need to look at how you have used your home when you sell or dispose of it before you can work out if there is any CGT to pay.

If you use a room in your home for both business and private purposes – for example, you use a room as an office, but you also use it as a guest bedroom – this will not impact availability of relief from CGT.

If you use any part of your home exclusively for business purposes – for example part of your home is used as a workshop for your business – that part will not qualify for main residence relief. But you will still get the relief on the part used as your main home. This means that if you sell your home at a profit, you have to work out the amount of relief due and work out if there is any CGT to pay.

Foster carers and shared lives carers

Foster and shared lives (adult placement) carers can claim main residence relief on any gain accruing to them from the disposal of their main residence, even where part of the house has been used for fostering or supporting a shared lives service user.

Accordingly, both foster carers and shared lives carers may now qualify for full relief when they come to sell their residences in which they have looked after the children or adults in their care, provided that they satisfy the other conditions for the relief.

Care home residents

If you dispose of a property which has been used as your only or main residence at some point in the period of ownership, the final period exemption is extended from 9 months to 36 months if both of the following apply:

- At the date of disposal, you are disabled or long-term (that is, for at least three months) resident in a care home.

- You do not own any other property which has at any point been your only or main residence.

The 36-month extension can also apply if your spouse or civil partner is either disabled or long-term resident in a care home, provided the second bullet point is true of your spouse or civil partner as well as you.

Job-related accommodation

If you own a property which you intend to occupy as your only or main residence, while you live in other job-related accommodation you are treated as if you lived in your own property as a main residence. This will continue for as long as you have such an intention, even if you never actually occupy that property. Any gain arising for that period of time is therefore free of CGT. You should keep evidence of your intention to occupy the property as a main residence.

If your intention changes and you no longer intend to occupy the property you own as a main residence, you will be eligible for relief up to the point your intention changed. You should keep records which indicate the change of intention. You are still entitled to the relief that always allows the gain arising over the last 9 months of ownership to qualify for relief.

Armed forces

Service accommodation normally qualifies as job-related accommodation. This treatment also applies to the case where you receive an armed forces accommodation allowance towards the cost of accommodation which may be rented in the private rental sector (as opposed to accommodation which is provided directly by the Ministry of Defence).

These rules, together with the other rules on absences, mean that members of the armed services absent from home due to armed service-related activities will probably not have to pay CGT on disposal of their home.

Letting a room to a lodger

You should have been paying income tax on the property income arising from this activity unless your income fell within the rent-a-room provisions or property allowance.

Now that you are selling the property, the fact that you had a lodger should make no difference to the normal rules for selling a main home (see above), so long as you were physically living at the property while you had a lodger and you were not operating a trade. If you were running a business, such as a ‘bed and breakfast’ business from your home, you should take professional advice before you sell the property.

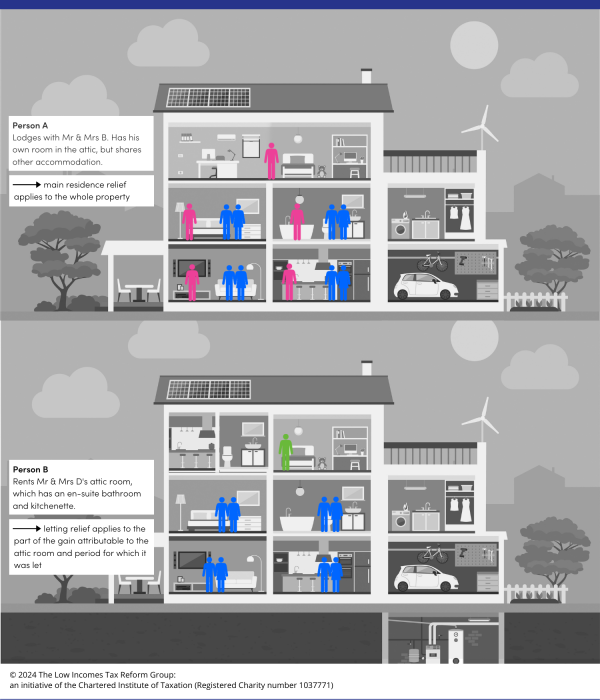

If you have a lodger who has lived as a member of your family (meaning that they share the living accommodation with you and have meals with you), then under an HMRC Statement of Practice no part of the accommodation is treated as having ceased to be occupied by you as your main residence. This means that having such a lodger will not restrict the availability of main residence relief.

However, it may be possible to justify that main residence relief should not be restricted in broader circumstances than the concession describes, provided the lodger does not have ‘exclusive use’ of any specific area and essentially shares the residence with you.

In other cases, the legislation allows for ‘letting relief’ (see below) if part of the home is used as your only or main residence and another part is let out as residential accommodation.

HMRC acknowledge that “the domestic arrangements of individuals are endlessly variable”. Accordingly, sometimes it may be unclear which rules apply. However, sometimes you may conclude that no CGT is payable for any arguable scenario.

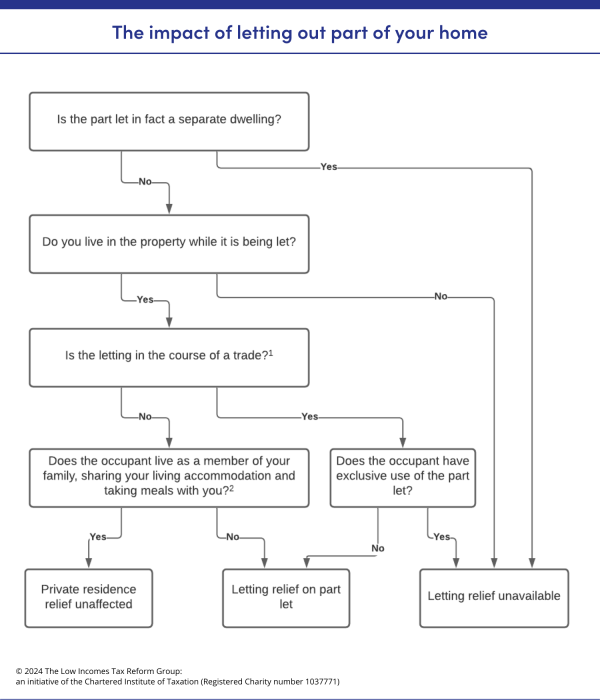

The impact of letting out part of your home can be summarised by the following flowchart:

Notes

- HMRC draw a distinction between, for example, a private individual taking a lodger into their home and someone who is running a lodging house as a business. If you have more than one lodger, HMRC may consider this a sign that you are operating a trade. You should seek advice if you are unsure, though note that letting relief may apply in any case.

- For details, see HMRC's Statement of Practice 14/1980.

If you let out the property and did not live there yourself, you should consider whether any relief is available for those periods under the general provisions for periods of ‘deemed occupation’ described above.

Letting relief

For disposals on or after 6 April 2020, it is necessary for the owner to live in the property at the same time as the tenant in order to be eligible for ‘letting relief’ for the period of the letting, even for periods prior to 6 April 2020.

If you rent out a distinct part your home during ownership, when you come to sell the property ‘letting relief’ may be available to cover the gain that is attributable to the part of the property which has been let. This relief is now only available on disposals where the owner was living in the property at the same time as the letting. If you let out the property and did not live there yourself, you should consider whether any relief is available for those periods under the general provisions for periods of ‘deemed occupation’ described above.

‘Letting relief’, where you let out a specific and identifiable part of the property (to which the occupant will normally have exclusive use), is different from the ‘lodger’ situation described above, where the individual lives with you and shares the accommodation with you in broadly similar circumstances to where the rental income would qualify for rent-a-room relief. This is illustrated as follows:

If the part let out has its own separate entrance (for example, it is a self-contained annex), then HMRC may take the view that it is actually a separate dwelling entirely. In this case, if you have not occupied that separate dwelling as a main residence yourself then you would not be eligible for letting relief on its disposal. If you are in any doubt, you should seek advice.

Provided the part let is considered part of your main residence and not a separate dwelling, for letting relief there are four steps to take:

- Work out any capital gain arising.

- Next you should work out how much of the gain will be fully relieved because you occupied (or were deemed to occupy) the whole property as your main residence, including the final nine months of ownership.

- If there is any unrelieved gain remaining, you need to work out how much of that unrelieved gain relates to the period during which part of the property was let.

- For this part of the gain, you will then need to decide what proportion relates to the part you lived in and what proportion relates to the part which was let as residential accommodation. The apportionment should be done on a just and reasonable basis.

Letting relief is then the smaller of the following:

- £40,000

- the amount of main residence relief given

If you think you are eligible for letting relief under these rules, we strongly suggest you seek advice as the calculation can be complex.

Homes owned overseas

If you are selling a home that is located overseas, the first thing to check is whether you are liable to CGT in the country where the property is situated.

As far as CGT in the UK is concerned, it depends on your residence status when the property is sold.

If you are resident in the UK when the property is sold, then you need to calculate any gain arising, taking into account any main residence relief that might be available. If there is a gain arising, you need to calculate the tax payable. You may be able to set off any overseas CGT that you have paid on this disposal against your UK CGT liability. This is called double tax relief. This is a complex area and if this applies to you, you may need to take professional advice.

If you are a temporary non-UK resident, then you need to perform the calculations as above when you return to the UK and you may have tax to pay.

If you are non-resident in the UK (and not temporarily non-resident) when the property is sold, then no CGT will be due.

If you have paid tax in the overseas country, please refer to the HMRC manuals, which have some information on double tax relief.

Calculating the gain

If you have not occupied your home (on an actual or ‘deemed’ basis) for the entire time you have owned it, then you may have to pay some CGT when you sell it.

You can find general information on how to calculate CGT on our main Capital gains tax page.

You can find detailed information about calculating a gain where there is only partial main residence relief in HMRC’s helpsheet 283 on GOV.UK.

The important thing to realise is that any gain you make on the sale of your only or main residence is deemed to accrue evenly over your period of ownership of the property. This means that if you owned the property for 8 years before selling it, and the gain on sale was £40,000, then the gain is deemed to have arisen at the rate of £5,000 per year (£40,000 divided by 8 years). It does not matter for CGT purposes if in fact the property sharply increased in value over, say, the first three years and then stayed at the same value for the next five years.

If you have only lived in your home (or been deemed to have lived in your home), for say 6 out of 8 years then 6/8ths of the gain will be qualify for relief and 2/8ths will be chargeable (that is, using the above example figures, £30,000 will be qualify for relief and £10,000 will be chargeable).

You may use your CGT annual exempt amount against this gain (and, if jointly owned, the other owners might have their own annual exempt amount to set against their share of the gain).

Mortgages

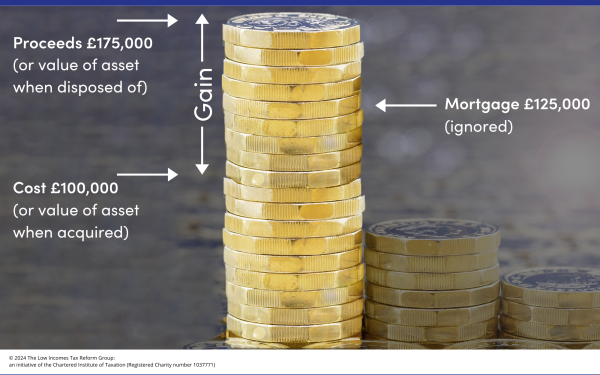

The capital gain is the difference between the amount you sell the property for, and the amount you paid for it.

Any mortgage balance is ignored. Therefore, if you have remortgaged the property and the amount of your mortgage is more than the amount you paid for the property, you can still only use the amount you paid for it to calculate your gain.

For example, you buy a property for £100,000, three years later you remortgage for £125,000 and then after you have owned the property for 8 years you sell it for £175,000. The gain is £175,000 minus £100,000 which is £75,000. The fact that you are only going to receive £50,000 once you have paid off the mortgage is irrelevant. This is illustrated below:

Making a loss

If you are disposing of a property which has been your only or main home throughout the entire period of ownership, or otherwise if main residence relief would have applied in full if the disposal had been at a gain, then the loss cannot be offset against other capital gains.

If main residence relief would not have applied in full on the disposal, it is possible to offset the loss which relates to the part that would not have qualified for main residence relief.

This loss is first offset against capital gains made in the same tax year, if there are any, and any remaining loss is carried forward to offset against gains in a future tax year.

In certain cases, such as where you wish to offset or carry forward such a loss, you will need to report the disposal to HMRC.

See also Capital losses.

Jointly-owned property

Normally each person’s share of a gain is calculated based on their own circumstances, but there are special rules for married couples and civil partners.

Where one spouse or civil partner qualifies for main residence relief, for example because they are living in job-related accommodation, then the other spouse or civil partner will qualify.

If the property is owned by two or more people who are not married or in a civil partnership, then each person’s share of the gain is calculated separately. This means if you own a property with your partner, but you are not married or in a civil partnership with them, their share of any gain on the sale of your main residence may not qualify for reliefs in the same way that any gain arising on your share of the property would.

If a main home, or an interest in a main home, is transferred from one spouse or civil partner to the other, then the receiving spouse or civil partner is deemed to acquire that interest:

- at no gain, no loss – in other words, they inherit the base cost of the transferring spouse or civil partner,

- at the same date that the transferring spouse or civil partner acquired it, and

- the receiving spouse or civil partner ‘inherits’ from the transferring spouse or civil partner the history of whether or not that property has been used as a main residence.

For example, suppose you purchase a buy-to-let property in June 2019 and you transfer a 50% interest to your spouse in June 2024 at which point you both move into it as a main residence, and you then sell the property in June 2029. Upon sale, you would each be deemed to have owned the property for 10 years and have used it as a main residence for 5 out of the 10 years, even though your spouse will have only actually owned their share for 5 years and used it as a main residence for 100% of their period of ownership.

More information

GOV.UK has some basic guidance on selling your home.