Pay and deductions

In this section we look at some common pay elements and deductions. This includes guidance on the minimum wage, holiday pay, sick pay and auto enrolment.

In this section we look at some common pay elements and deductions. This includes guidance on the minimum wage, holiday pay, sick pay and auto enrolment.

This section explains a bit more about HMRC's Real Time Information system, including dedicated pages on the software available to help you file online, and the alternative paper process.

When you take on a new employee, you will need to gather some information from them including their National Insurance number and tax code per their P45 or Starter Checklist and record it somewhere safe. You will also need to decide how often to pay them.

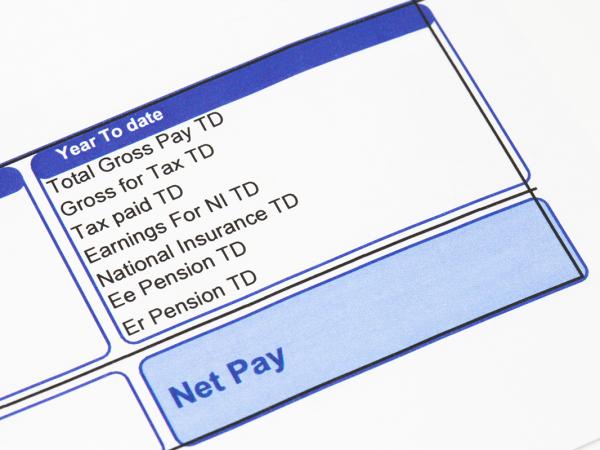

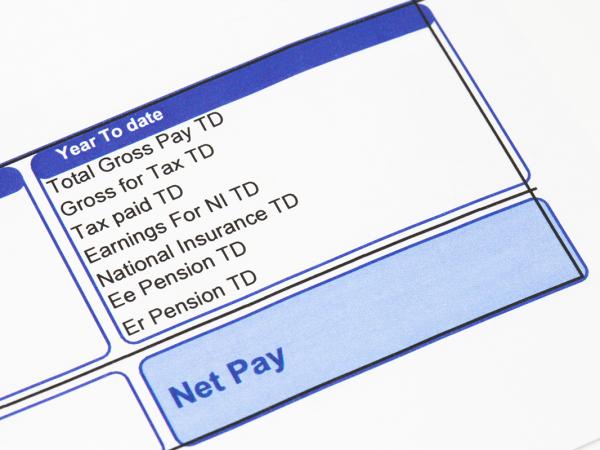

On this page we tell you more about how PAYE deductions work. For most employers, their PAYE deductions will be handled by their payroll software. Even those who are running their payroll manually can access help in the form of PAYE tax and National Insurance calculators. Nevertheless, if you want ...

Here we look at some general considerations around setting yourself up as an employer – this includes providing more detail about two key aspects – registering as an employer, and your payroll filing options. You should also start planning for automatic enrolment, because as soon as you take on an ...

When you hire someone, for tax purposes you need to understand whether the law sees them as your employee or sees them as self-employed. If they are your employee then you have important responsibilities, including deducting tax and National Insurance from their wages and paying the money over to ...