Trusts for disabled people

We look at the special tax rules that can sometimes apply when a trust is created for the benefit of a disabled person.

We look at the special tax rules that can sometimes apply when a trust is created for the benefit of a disabled person.

If you are a trustee or personal representative, you may need to register your trust or a deceased person’s estate under the trust registration service. This page gives an overview of whether and how you need to register.

If you receive some income from either a trust or from the estate of a deceased person, you may have further tax to pay on the income or you may be able to claim a tax refund. In some cases, you are taxable on trust income even if you do not receive it, but you can follow the guidance below as if ...

You pay National Insurance contributions (NIC) to build up your entitlement to certain state benefits, including the state pension. We look at what happens to your NIC payments once you reach state pension age.

National Insurance credits are different from National Insurance contributions. Credits are sometimes given in certain situations where you do not work, or only have a limited ability to work and therefore might not be paying National Insurance contributions. These credits protect your future ...

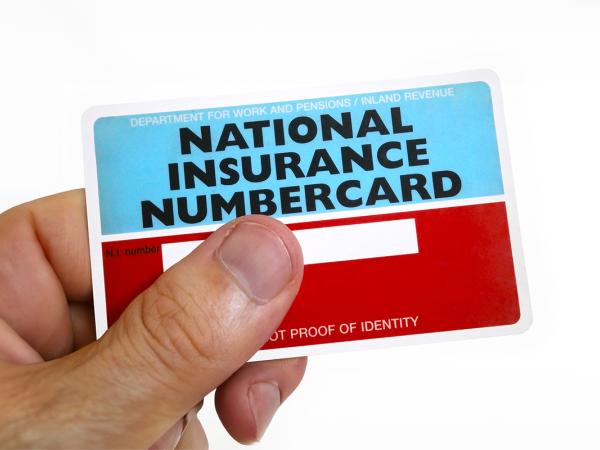

If you want to work or claim benefits in the UK, you must have a National Insurance number (NINO). On this page we explain what a NINO is, where to get one and what to do if you lose or forget it.